Low-risk portfolios defy the description and post average losses of 12.7% this year

18 Oct, 2022

Press release

Data published by Boring Money shows that DIY investors who have selected low or medium risk portfolios are more likely to have suffered heavier losses in 2022 than those who have selected a higher risk option.

All ‘ready-made’ investment portfolios have recorded negative returns since the beginning of 2022

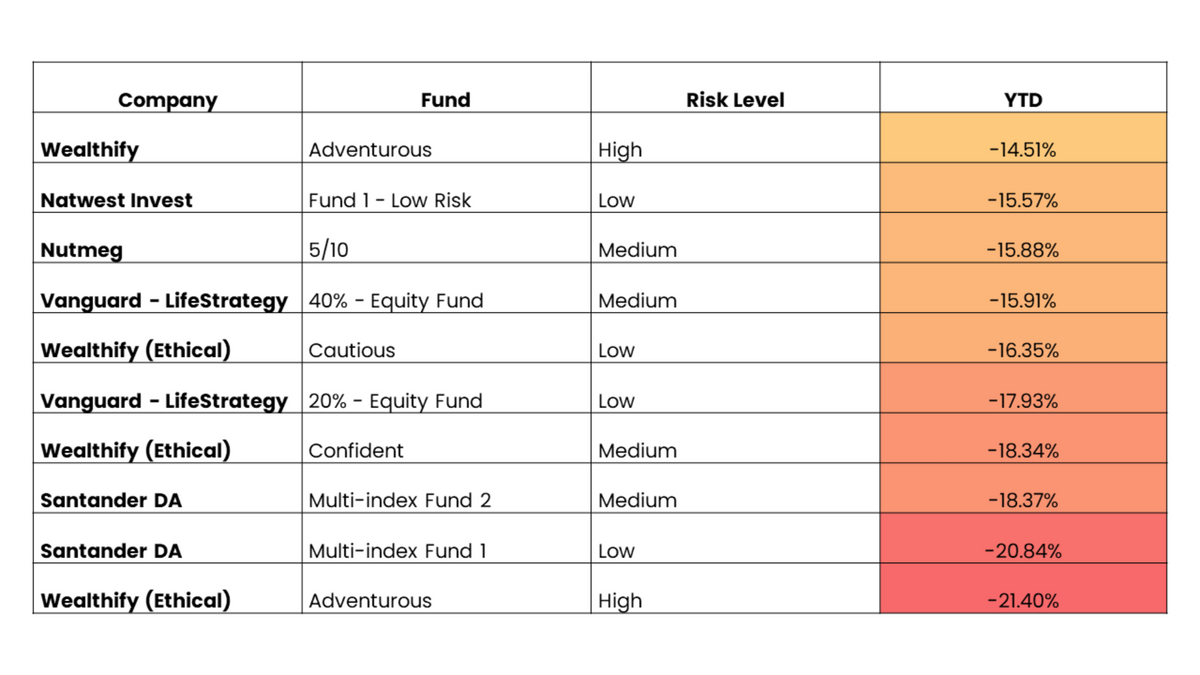

8 portfolios or funds in the lowest 10 by performance in 2022 have been ‘low risk’ or ‘medium risk’ portfolios – 4 of these are ‘low risk’ options

50% of the top 10 performing ready-made portfolios YTD have been ‘high risk’

The average ‘low risk’ portfolio has returned -12.7% YTD compared to an average return of -11.7% for the ‘high risk’ options

Boring Money has published the YTD (year to date) performance of 33 leading ‘ready-made’ investment portfolios, from 10 of the industry’s main providers of ‘ready-made’ portfolios or funds for consumers. These providers include popular options for DIY investors across a range of business models - platforms such as AJ Bell and Hargreaves Lansdown, robo advisers such as Moneybox, Nutmeg and Wealthify, and leading global multi-asset fund provider Vanguard.

In 2022, AJ Bell and Moneybox have posted the best performance, across various risk profiles

Top 10 best-performing ‘ready made’ portfolios and funds in 2022 (1 Jan 2022 – 30 Sep 2022)

Data correct as at October 2022; returns calculated net of charges

Bottom 10 performing ready-made portfolios and funds in 2022 (1 Jan – 30 Sep 22)

Data correct as at October 2022; returns calculated net of charges

Boring Money CEO Holly Mackay comments:

“There are many factors behind these performance numbers, from the expected underperformance of ethical options which exclude fossil fuels, the upheaval in bond markets and especially UK bonds, and also the approach taken to hedging in light of a strong US dollar.

“Although 9 months is not long enough to support any conclusions about a provider’s performance credentials, it is long enough to call into question again the description and positioning of ‘ready-made’ portfolios to novice investors.

“It’s hugely difficult to get the right balance between simplicity - but also arming people with the right expectations around the journey they can expect.”