Market Monitor

Market Monitor is our quarterly report we produce for those who are planning, launching or operating investment and pensions services direct to consumers in the UK market today. We use data and insights from three key sources – major DIY platforms, our consumer surveys and reports, and observations from our own site and Best Buy tables.

The report is used by clients to inform Board and senior management reports, to feed PR and investor relations reports, to inform digital marketing teams on market activity and consumer trends, and to provide ongoing competitor intel.

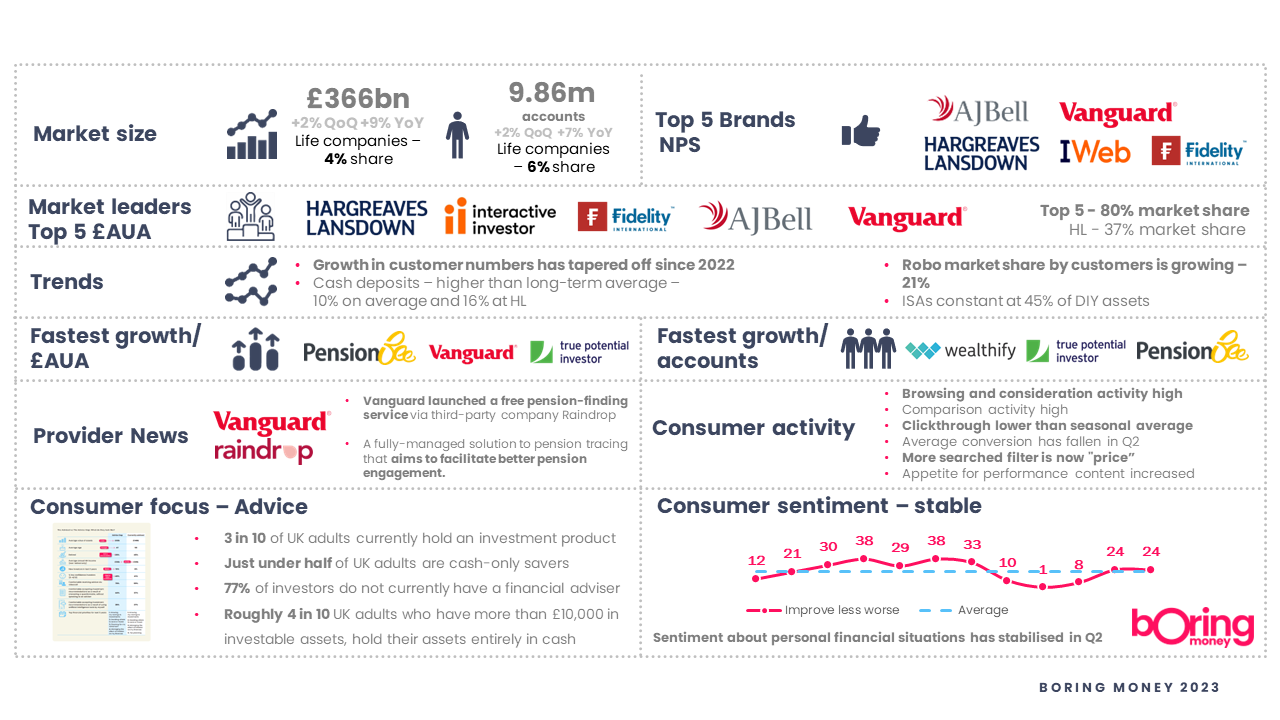

Overview

Market Monitor provides quarterly data on:

The latest market size, including £AUA and investors

Market shares and growth

A summary of key provider updates and proposition changes to stay abreast of competitor developments

A deep dive into a topical consumer segments with broader insights on consumer sentiment and behaviours

Each iteration will detail key insights surrounding:

Quarterly ongoing updates on the DIY investment platform market

Market share trends and growth for competitors

Teachings on proposition changes and developments in the D2C sphere

Insights on consumer behaviours and sentiment

What is included?

Data extracted from major DIY platforms, asset managers, and banks.

Data supplied and aggregated by 20+ D2C investment platforms, and 5+ years of consumer research and market sizing conducted by Boring Money

A survey of over 6,000 nationally representative UK adult, circa 6,200 UK DIY platform users, circa 500 Boring Money users, an ongoing survey of 500 fundholders per month with tracked data going back for 4+ years, and 5+ years of consumer research and market sizing conducted Boring Money

What the survey covers

Aim: to provide a comprehensive, data-driven overview of the UK D2C investment platform market’s performance.

Understand market dynamics - highlight growth leaders and laggards among providers for strategic comparison

Identify emerging trends across AUA growth

Support data-led decision-making for commercial, product, and marketing teams

Provide historical context with five-year growth trajectories to illustrate longer-term structural changes in the market

Aim: highlight key developments, strategic shifts, and pricing or product changes among leading D2C investment platforms and financial services providers, offering timely insight into the competitive landscape and emerging trends.

Keep stakeholders informed of material business changes (e.g. M&A activity, leadership shifts) that could impact market positioning and campaign execution

Track product innovation and platform enhancements across the market

Identify pricing adjustments and promotional strategies

Provide early indicators of shifting market dynamics that could influence future strategy or investment

Aim: provides actionable intelligence to tailor propositions, improve engagement, and explore evolving investor behaviours, preferences, and sentiment across different demographic groups.

Identify key product selection drivers, such as trust, low fees, ease of use, and brand reputation

Track engagement patterns, such as frequency of portfolio reviews or trading activity, to inform communication and UX strategies

Gauge investor confidence and sentiment about personal finances and the wider economy to anticipate shifts in behaviour

Aim: To synthesise the key findings from the quarterly Market Monitor report into a concise, executive-friendly presentation

Receive dedicated consumer insights by the report authors for your cross-functional teams

Facilitate strategic discussions and planning sessions

What do you get from this?

The latest market size, including £AUA and investors

Market shares and growth

A summary of key provider updates, proposition changes, and competitor developments

A deep dive into consumer segments, with broader insights on consumer sentiment and behaviours

Data Sources

Our quarterly Market Monitor delivers a comprehensive, data-rich view of the UK direct-to-consumer investment and pensions landscape. Each quarterl report includes:

• Aggregated platform data from 20+ leading DIY investment providers, asset managers, and banks, giving you a robust view of current market dynamics.

• 5+ years of research, including market sizing, platform analysis, and long-term consumer trends.

• Insights drawn from a deep pool of survey data, including:

6,000+ nationally representative UK adults

6,200 UK DIY platform users

500 Boring Money panel users

A rolling monthly survey of 500 UK fundholders, with 4+ years of tracked, longitudinal data

Pricing

£13,250 + VAT per annum to include 4 reports a year.

Get the latest Market Monitor today

Please contact rachel@boringmoney.co.uk for more information or to request a call with the research team.

Our top picks

Explore more of our products to gain valuable insights and learn how we can help your strategy and propositions through our services.