Our Sustainable Disclosure Prototype

11 Aug, 2022

Sustainable Investing - often referred to as ESG (Environmental, Social and Corporate Governance), has become a hot topic in recent years.

We know how tricky it is to compare sustainable funds, which is why we developed a prototype to:

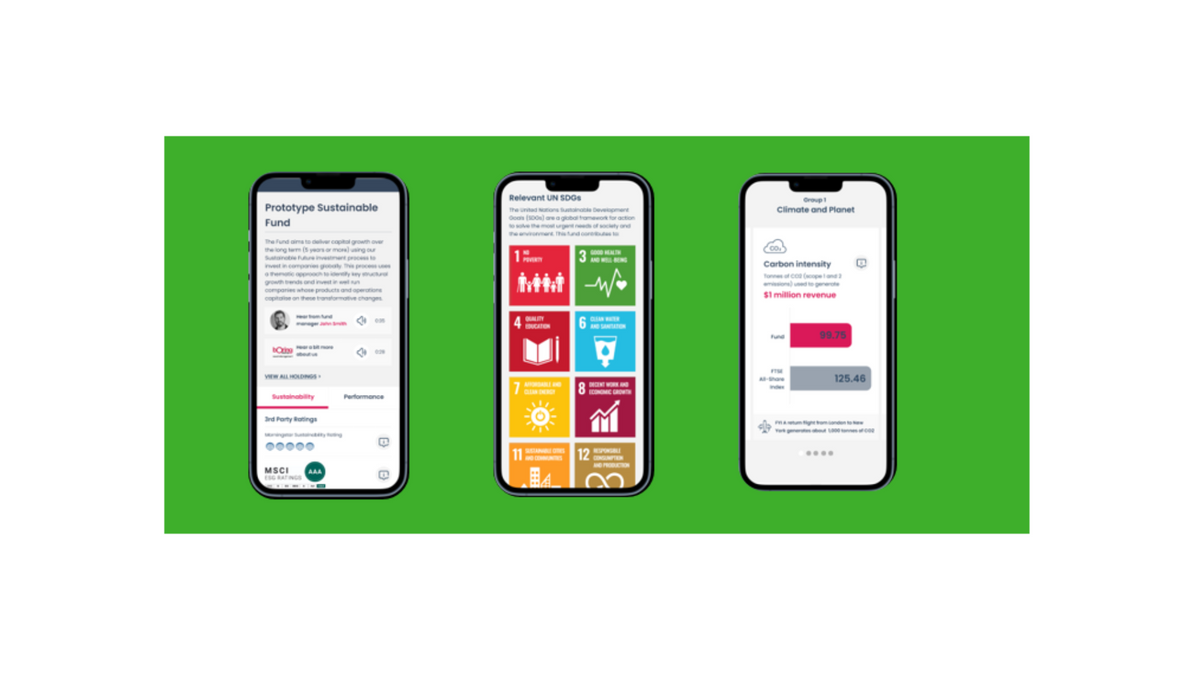

Be mobile first

Be visually clear

Answer the questions people have around sustainable funds

This syndicated piece of research aims to help you research sustainable investments, by making it easier to compare funds and different metrics.

As part of this, we created a prototype in partnership with Abrdn, Alliance Bernstein, Aviva, BMO, Legal & General and Schroders, which we tested with consumers to understand the DO’s and DON’Ts of sustainable communications.

What we did:

Included key questions in our Boring Money Investor Tracker: 1,626 fund investors (Q4, 2021).

Asked 120 blog readers to group Sustainable Development Goals into logical, useful categories.

Engaged 20 investors for 1-on-1 60 minute interviews to review our prototype.

As you can see in Graph 1 below, you gave us plenty of suggestions.

Key findings from this data:

More than 4 in 10 of the investors we surveyed said they wanted independent research agency ESG ratings with high-level summaries.

More than a third said they want to see how much carbon emissions (volume of CO2 in metric tons) was created by the companies within the fund.

More than a third also said they want to see how much renewable energy was created by the companies within the fund.

So we spoke to fund managers about the realm of the possible

Accurate data is not always easy to find. And comparing like with like is difficult, if not impossible.

We wanted to find a practical solution which could make things better today. Not just pontificate about what should be.

We engaged with Abrdn, Alliance Bernstein, Aviva Investors, BMO, Legal & General, and Schroders.

Many of the fund managers we spoke to use the United Nations’ SDGs (Sustainable Development Goals) to articulate their aims and objectives.

We asked our blog readers for help with the SDGs. 120 replied.

We asked you to categorise the UN SDGs in to groups that made sense to you. From analysing consistent approaches by the readers, we split the EDGs into 3 groups.

Click here for the full prototype.

Check out the prototype to learn more about how we split the SDGs into groups.

Armed with this data, we approached our designers

We knew that these summaries needed to include:

Information on the fund manager.

Information on the fund manager brand.

Some key stats and proof points on the climate-related metrics

Some examples which tell the story.

So what did we include in this prototype?

We ranked SDG metrics based on our readers' feedback.

Next, we assembled them into groups and presented them as a carousel.

We made sure that each metric was compared to a relevant benchmark to make it easier to put the data into perspective.