Advised Investors - Acquisition and Retention

This report provides essential insight and data for advice firms and consolidators shaping their immediate and long-term strategy and business planning. It analyses future growth in the advice market digging into both acquisition and retention, looking at key drivers including satisfaction, intergenerational transfer and the impact of Targeted Support.

Key sections

Table of Contents

To understand the different sections of the Advised Investors Report, please download the free Table of Contents.

Acquisition: Sample Insights

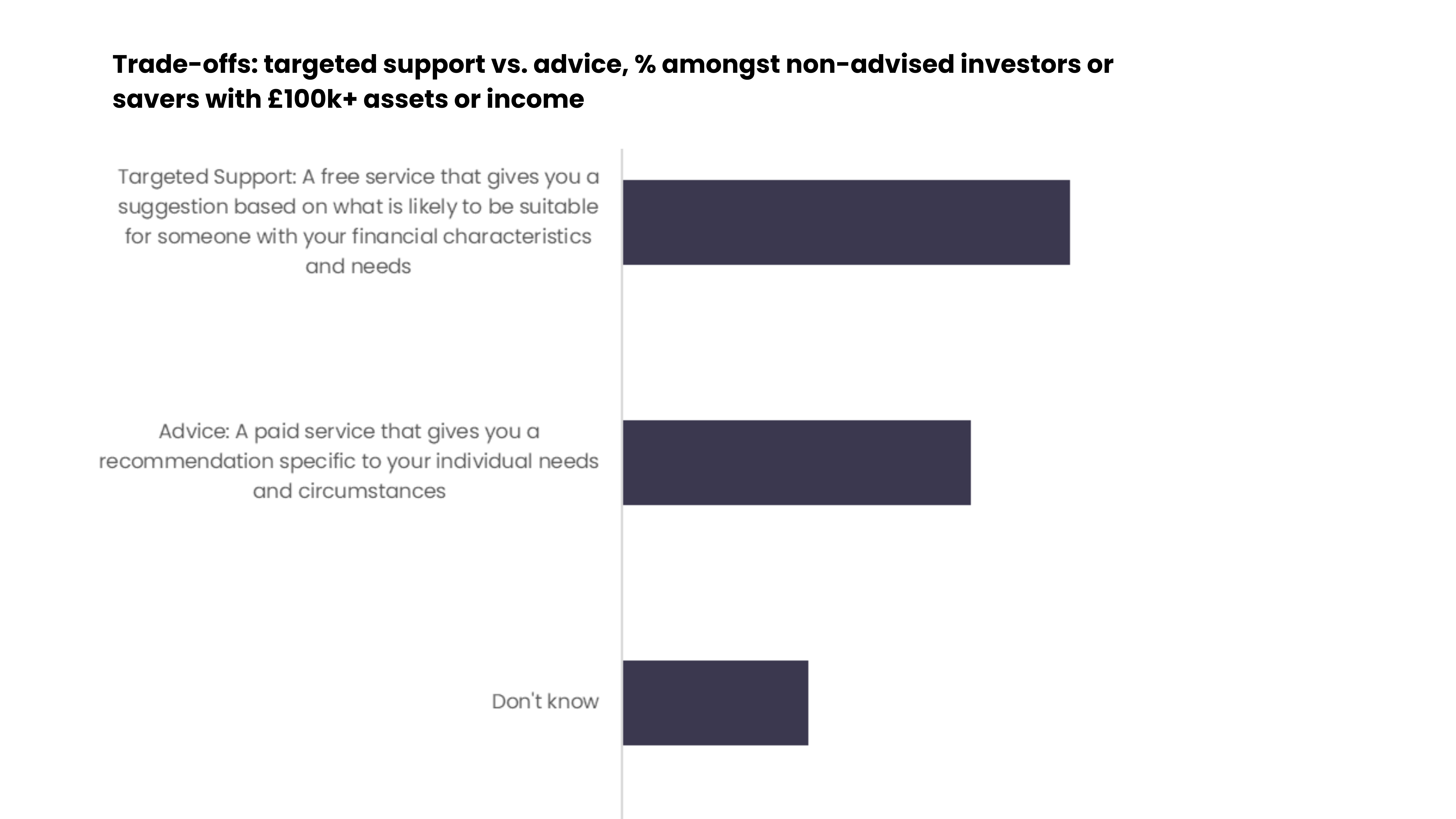

Growth will be fuelled by the acquisition of new clients. We anticipate that Targeted Support will play a small part in activating some new clients over the coming years.

Our research identifies c. 800k potential advice customers with sufficient assets to be advised today

We estimate there are 5.9 million people who would be open to Targeted Support solutions, some of whom will upgrade to full advice

Retention: Sample Insights

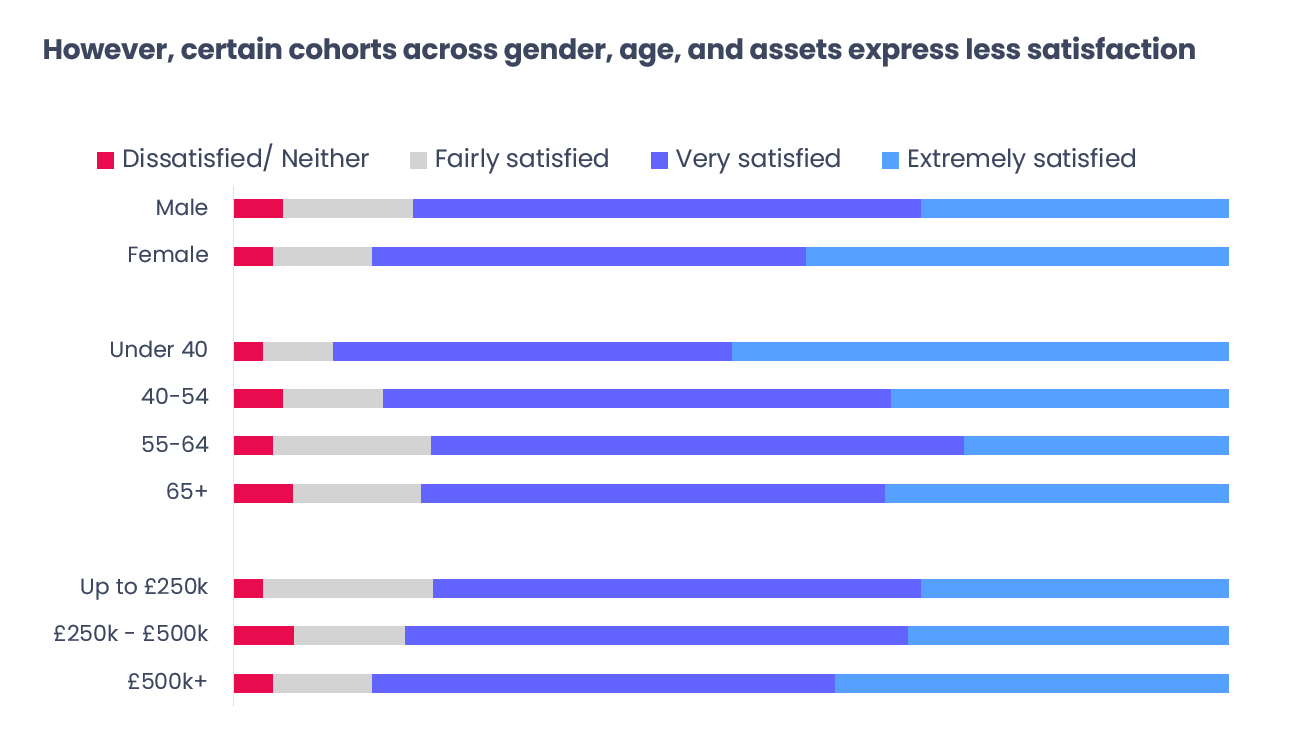

The report will also assess retention based on current client insights and data from advised parents on the anticipated behaviour of their children and heirs. We investigate the main drivers of low satisfaction, supporting a pre-emptive approach to both retention and reputation.

• 500k current advised clients rate themselves as ‘less than satisfied’ with their adviser

• 26% predict their heirs will leave family adviser

• Over one quarter of parents over 65 said that they did not think that their children would stay with their current adviser in the future

What's in the report?

A review of how targeted support will likely impact acquisition tomorrow if not today

An understanding of the potential uptake of advice from the 800,000 UK adults who have sufficient assets to be advised clients

A look at the pipeline of high-income adults who are building wealth today and will need advice tomorrow

Insights from older, affluent advised parents on what they forecast their children will do when they inherit or are gifted money

Data to support an understanding of satisfaction levels today and the risks around retention

Understanding barriers to receiving advice

Understanding the main drivers which lead to clients leaving

Data to support modelling and business planning

Who is it for?

• Advice firms and wealth managers building out business plans for 2026 and beyond

• Consolidators and PE firms wanting to evidence and sense-check forecasts

• Firms interested in the advice sector wanting consumer data to model and forecast with confidence

Sources:

Survey of 3,000 nationally representative UK adults, May 2025

Survey of 1,000 advised investors with £100k+ in assets, August 2025

Survey of 450 Boring Money panel members with £100k+ in assets, mix of advised, advised in the past, and non-advised, August 2025

Want to learn more?

Talk to rachel@boringmoney.co.uk today about how the Advised Investors Report can support your business strategy.