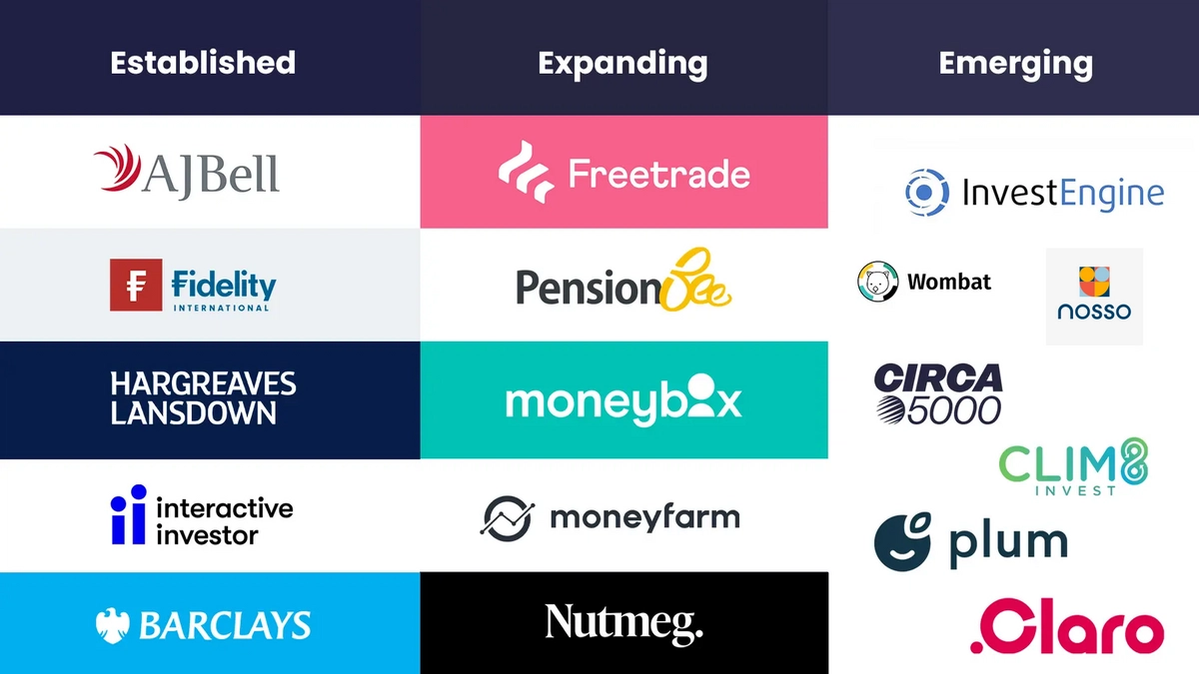

Established, Expanding, Emerging: The 3 tiers of DIY investing

23 Feb, 2022

DIY investing

At Boring Money our team of research analysts study the DIY investing market closely to understand how the competitor landscape is evolving. We channel these findings into our Reports and Data Subscriptions products - Saver & Investors Analysis and Fund Investor Tracker.

One of the things clients often want is a picture of the competitive landscape – which providers are developing scale and growing, who holds dominant market share and can they retain that position, and which disruptors are making ground on the competition.

We’ve studied this in depth as part of our flagship 2022 Online Investing Report. It’s clear the market is developing into three distinct groups of providers with their own particular characteristics.

The Established:

Just 5 well-established platforms hold more than 70% of total AUA across the DIY investing landscape. Within this cohort, Hargreaves is notably larger by a significant margin.

These providers tend to appeal to a wealthier, older and more male audience.

Services are aimed at hobbyists – most of the platforms in this group are a balance between accessibility and convenience, while also having the depth of research, comparison and analysis tools to satisfy the enthusiastic investors that want more than just a set-and-forget portfolio.

The Expanding:

Most of you will probably be familiar with the established incumbents. But what about those coming up in the rear view mirror?

The Expanding group includes the likes of Freetrade, PensionBee, and robos such as moneyfarm. Although they but don’t yet have the scale of their more established peers, these providers are gaining momentum and with several having attracted new funding in 2021, are in a position to invest in future growth.

The Emerging:

Our ‘Emerging’ group of providers have a developed innovative new propositions to challenge the status quo.

We can summarise these as:

•Low-cost administration or free trading – Freetrade in particular has an attractive pricing model for those that want to deal in shares

•Thematic investing – A number of newer providers are focussed on thematic investing. Wombat came to market in 2019 and offers a range of popular shares alongside roughly 30 thematic investment options such as The Electric Car Revolution, The Blockchain and The British Bulldog.

•Sustainable investing – Provider like the Big Exchange and Clim8 specialise in this area

•Investing as a secondary part of a bigger cash budgeting app – We estimate there are 6.6 million UK adults with £10k+ in cash but no investments. Several US banking brands and digital banks have stated an intention to add investments alongside their existing retail banking account offering.

•Coaching & guidance for the less confident – A number of providers are offering, or plan to launch, financial coaching. A paid for service, it provides help - and it some cases a route to investing - without going as far as ‘Full Fat’ Financial Planning.

Find out more about the competitor landscape:

Our Online Investing Report explores the competitor landscape in detail including:

Analysing pricing across different provider types,

Growth rates by AUA and customer numbers

Key features assessed through our test accounts

Customer reviews for providers posted through boringmoney.co.uk