Advice Report 2022

A ballooning market

Are you charged with helping consumers to make better decisions about investments or pensions? Whether that’s content, best buy lists, coaching, online risk profiling or the Full Monty? If so, Boring Money’s new Advice Report is essential reading to help articulate, validate, size and implement your plans.

We size the advice gap, profile underserved consumers, and shine a light on what will drive demand. Are consumers looking for holistic advice, are they looking for fixed fee one-off advice, or do they simply need some coaching? How important is face-to-face in a changing world? And how much of a threat are robos to traditional advice services?

Key chapters in the report include:

Sizing the advice gap in £ and customer numbers - supporting you to validate and size your plans.

Identifying who is in the advice gap - which consumers are underserved and offer the biggest opportunity for advice services.

Where do people currently go to help, and what are the barriers to advice - helping clients understand the kind of conversations they need to be having with consumers, in order to break down barriers to advice

Mapping the consumer need across life-stages - identifying financial priorities by life-stage, where consumers need help, and what they are most willing to pay for.

Face-to-face, Digital, or Robo: Sizing demand and consumer segments – helping you understand the target market for your advice product

Holistic, one-off, or coaching: Understanding demand and consumer segments – helping you understand the target market for your advice product

Market analysis: Best practice & what’s changed in the last year – understanding the competition

Response from financial advisers – how has their business changed in the past few years

How do people choose an adviser? Knowing how to attract the new audience

Satisfaction amongst those already advised – is there a risk of a move to digital?

Sneak peak of our findings:

The Advice Gap

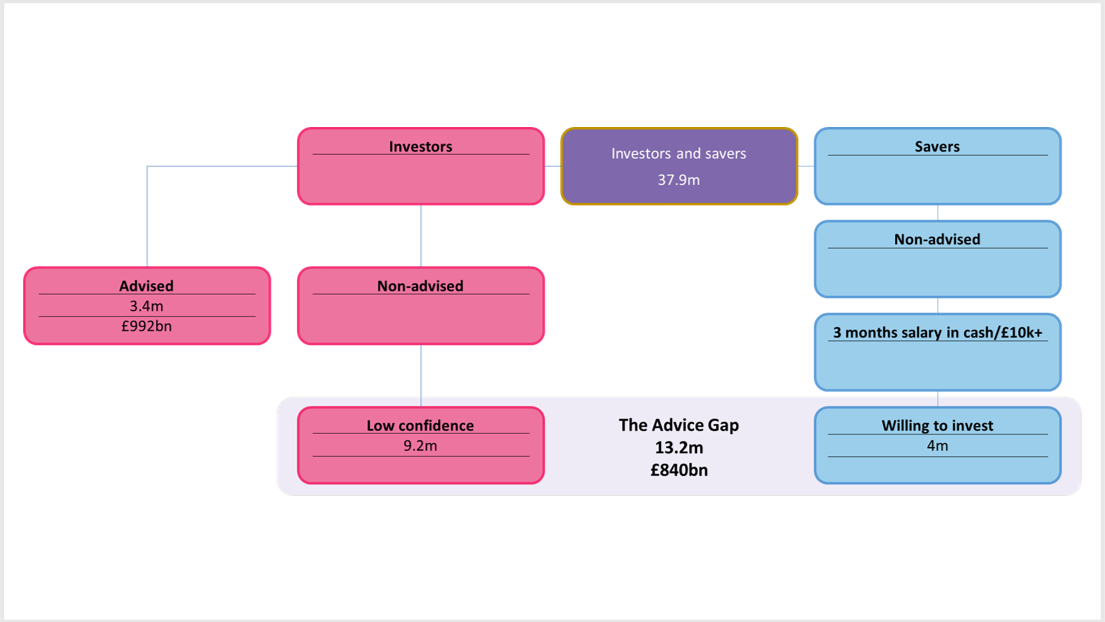

The Advice Gap continued to grow into 2022. We define the Advice Gap as 1) Investors who are not advised, and have low confidence when choosing investments, and 2) Cash savers with £10k+ or 3 months' salary in savings who are willing to invest. The growth of the Advice Gap has been spurred in over the past few years, as more investors came to the market over the course of the pandemic, alongside the growth in cash balances. We size the Advice Gap in people and £ to help companies build their strategy for the future.

Continue reading

Subscribe to unveil the page content! Enter your email address below.