Online Investing Report 2023

Introducing the report

We're delighted to introduce the 7th edition of Boring Money’s Online Investing Report – the essential resource for anyone wanting to understand the current DIY investing landscape, consumer behaviours and sentiment, emerging investment trends and predictions.

Our research team have benchmarked and tested 39 different providers. Our consumer research comes from a nationally representative survey of 6,107 UK adults.

Over 100 pages of consumer and adviser insights with the following chapters included:

The size of the UK DIY investment market and self-directed investors

Consumer insights on behaviours, sentiment, preferences and intentions

Regulatory change – Consumer Duty and value tracking; Simplified Advice and Guidance

The competitor landscape - a review of key platforms and supporting functionality

Best Buys 2023 – who and why

A look ahead at demand and supply – investor appetite and supplier pressures

Platform forecasts for 2023

Research

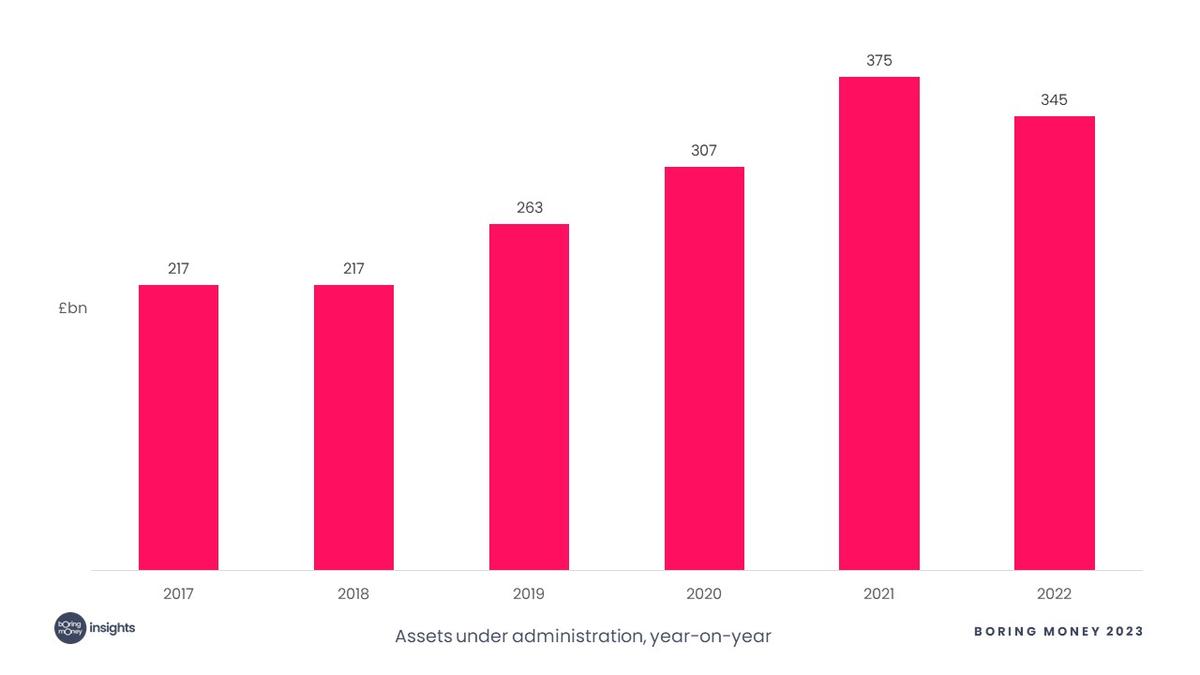

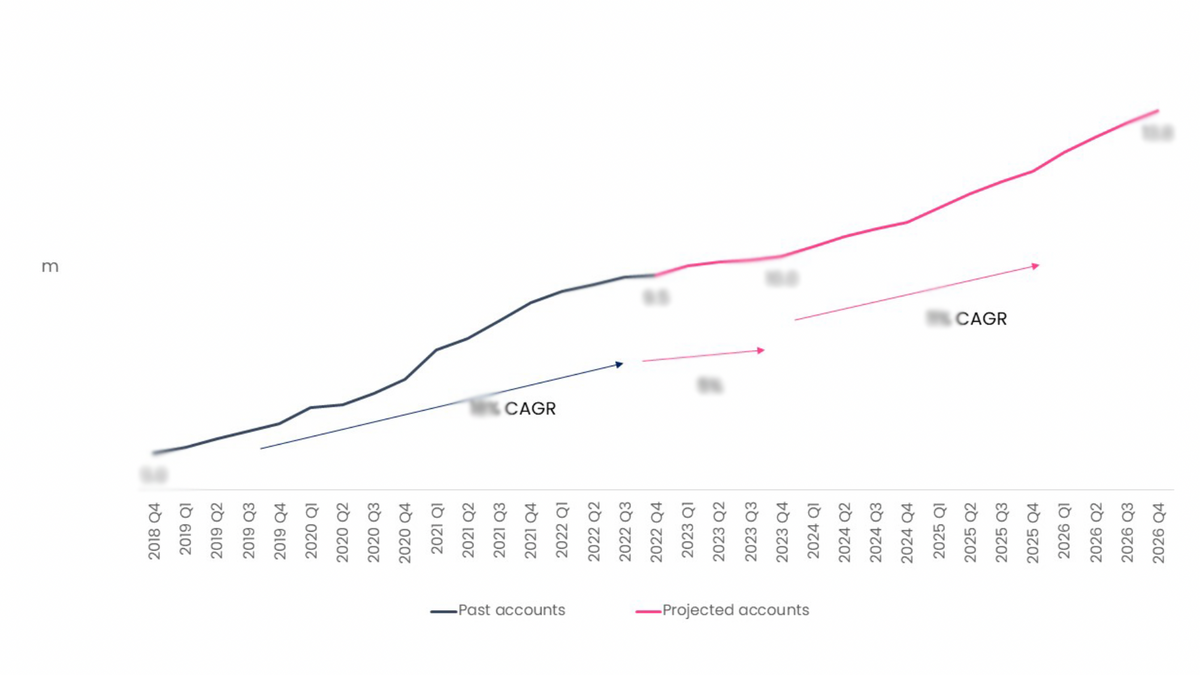

Market size and growth

AUA growth in the DIY investing market is in the negative, down 8.4% at the end of Q3 2022. Our research tracks data from all the leading DIY providers to chart AUA and customer account growth across the market. The Report identifies areas of the market growing the fastest and looks at the strategic challenges facing different provider groups.

Consumer behaviour

The report finds that the number of cash only savers has grown considerably since this time last year, as the rise in interest rates has encouraged people to save. Investors are torn between whether to put new savings in investments or cash, with cash seeming a reasonable option for many. This report explores changing behaviour in the wake of interest rate changes and an increased cost of living.

Illustration of contents – data withheld

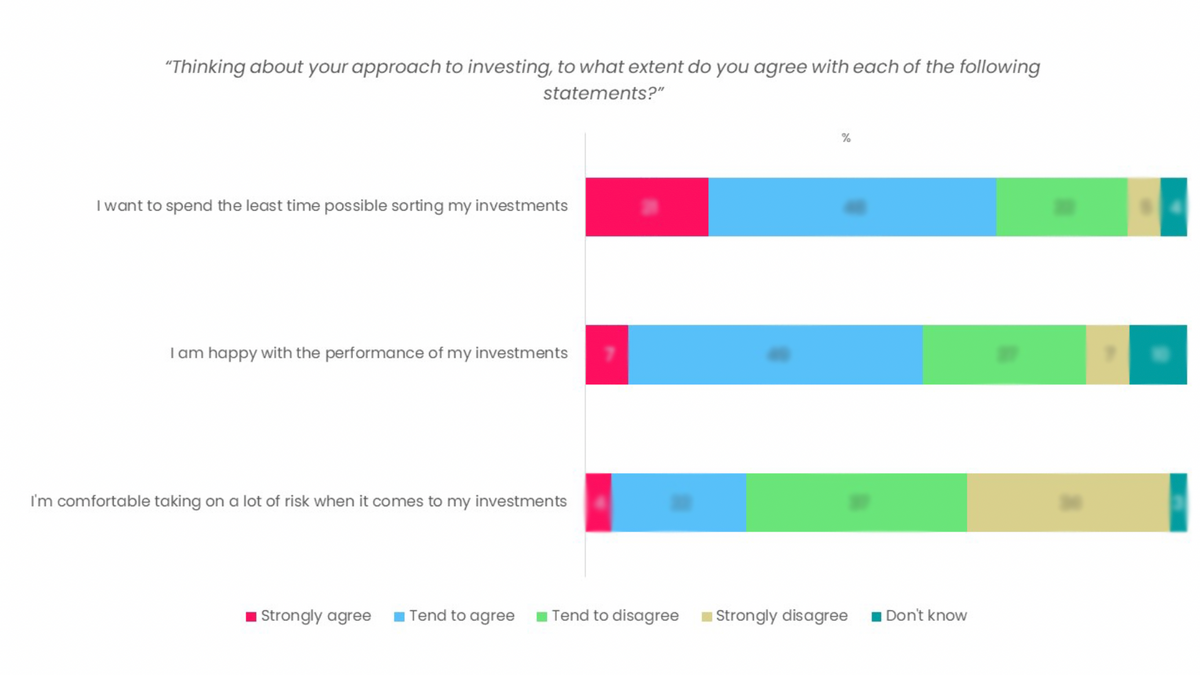

Investor and saver attitudes

The report details what both savers and investors want and how this has changed. Both existing and potential future investors have seen rapid changes in attitude to investing over a year of significant tumult. We track analyse these attitudes to help recommend what next for platform providers.

Illustration of contents – data withheld

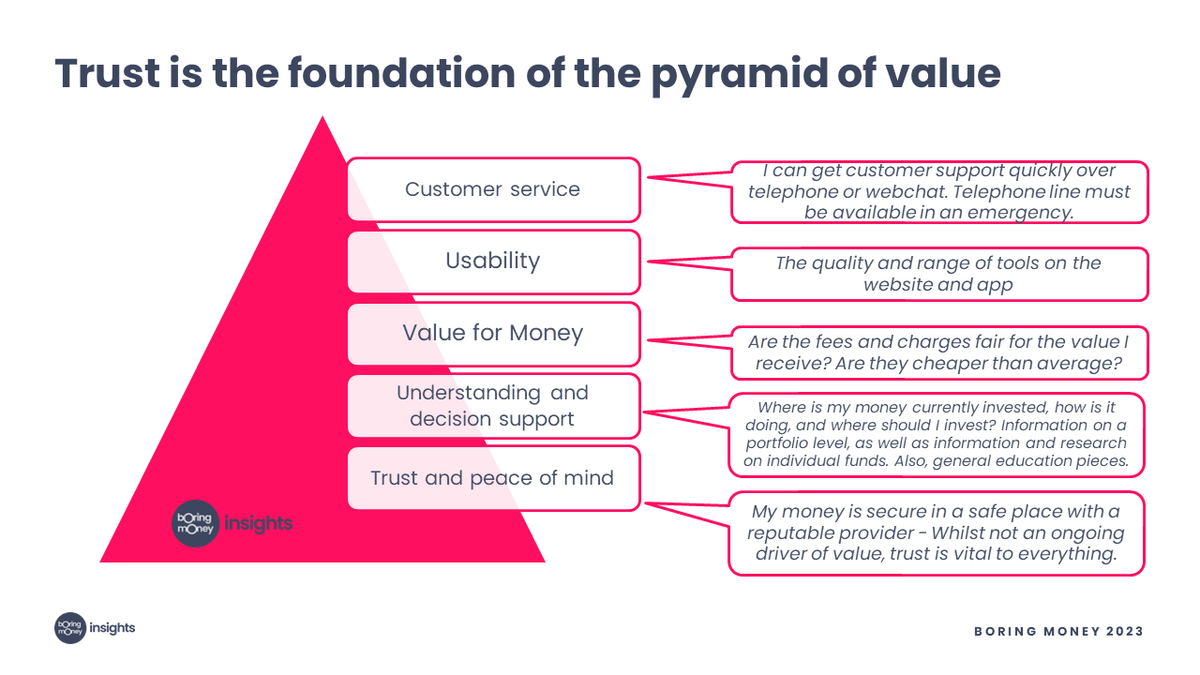

Consumer understanding

Consumer Duty regulates that firms must equip investors make investment decisions that help them achieve their objectives. The report gives detail on what current platform uses value as well as exploring consumers broader needs. For example, we detail awareness and understanding of commonly used investment terms, providing commentary on what this means for providers and next steps for responding to Consumer Duty.