News Response: Vanguard ends its reign as the lowest-cost option for smaller DIY investors but polishes its ready-made offer

12 Dec, 2024

News Response: Vanguard ends its reign as the lowest-cost option for smaller DIY investors but polishes its ready-made offer

Vanguard UK has today announced moves to implement a minimum fee for DIY investors in the UK. This will apply to all investors on Vanguard’s platform except for those who select either a managed ISA or pension product, or people with a Junior ISA.

With a minimum annual charge of £48 p.a, this effectively makes the service more expensive for anyone who has gone down the self-select path and has less than £32,000 invested on the platform.

Holly Mackay, CEO of Boring Money, comments “As at Q3 24, the average customer balance with Vanguard was £38,100. This move will impact a significant proportion of their customers, who are typically younger and have slightly lower balances held with Vanguard than the average platform customer”.

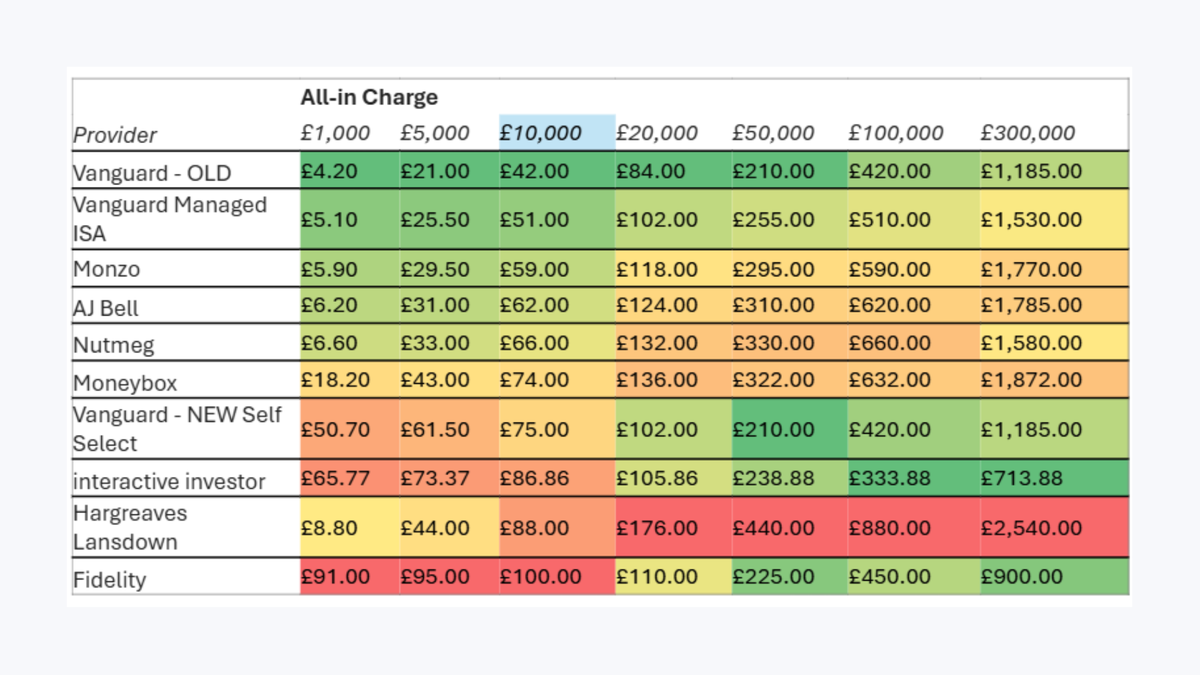

Table 1: Fees for ISAs modelled on the lowest-cost in-house solution

News Response: Vanguard ends its reign as the lowest-cost option for smaller DIY investors but polishes its ready-made offer

*See below for notes and assumptions

In the old structure, a £10,000 DIY portfolio in a LifeStrategy fund would cost £42 a year, the cheapest option available in the table above. The changes will increase the annual costs to £75 a year, making Vanguard notably less competitive for those who want the freedom to pick and choose.

The firm has also announced a reduction in the costs of its Managed ISA service to 0.51% a year all-in, reducing their management fee by 0.1%. With no minimum fee applied to this path, it makes the Managed ISA a more compelling route for many less confident or lower value customers.

Mackay observes, “It’s clear to see which horse they are backing – their Managed ISA service. Perhaps it’s no coincidence that this news comes on the same day that the FCA takes another step towards implementing Targeted Support, a move which Vanguard acknowledges and says “we wholeheartedly agree with the FCA that people need more help with their pensions and investments”. I expect we will see continued focus on vertically integrated solutions across the board in 2025 as more firms prepare for targeted support.”

“Vanguard has been the fastest growing platform by assets in the past year. Looking over a longer 5 year period, the platform has seen a remarkable rise in assets, increasing by c. 13 times to current figures of £25.5bn. But of course, businesses will also look at the bottom line, not just popularity metrics. There’s no such thing as a free lunch (unless you are vertically integrated and getting a subsidised lunch) and good service costs money. Hence the move to introduce the minimum fee.”

She continues, “Vanguard’s USP has always been about cost. Not service. This move has a subtle impact. It removes them from being an option where no-one needed to worry about cost. To an option where people need to do the Maths. So, on some grounds, they are not the slam dunk they once were. We saw a similar thing about 6 years ago when Charles Stanley moved its admin fee from 0.25% to 0.35%. Overnight, they lost their USP which had been always being the cheapest, so papers stopped citing them and consumers lost the ‘no brainer’ reason to select them.

“My guess would be this minimum fee will not have a significant impact on their book today, although some more informed consumers will inevitably switch out. But I suspect it will slow their pace of growth with some customer profiles in years to come.”

“The winners today are probably low-cost open architecture rivals such as AJ Bell who will be relatively more competitive for smaller accounts held by those who want to pick and choose. Smaller providers making a play on free-this-or-that, and low-cost-entry, may be anxiously reviewing the strategy, as such a big player announces an end to unprofitable smaller accounts. The clear message is that good service costs money.”

“Those with any doubts about the pendulum swing away from open architecture towards vertically integrated models will have another signal that this is a challenging model without the extra revenue from managing the money too.”

“But to be honest the whole industry will be breathing a sigh of relief as the Big Cost Pressure Valve has just been eased. As for consumers, at the end of the day, £48 a year for a decent investment service is arguably not a terrible customer outcome. It’s just not the ‘no brainer’ it once was. And the Managed ISA of course looks relatively more compelling”.

Portfolio assumptions:

Boring Money have selected a balanced option from the cheapest or most popular range of in-house ready-made investments where available

Transaction costs have been included where stated or publicly available

List of funds and price used per provider:

AJ Bell: AJ Bell Balanced fund – 0.37%

Fidelity: Fidelity World Index fund – 0.10%

HL: HL Multi-Index Balanced fund – 0.43%

ii: Managed ISA Balanced Index portfolio – 0.19%

Moneybox: Moneybox Balanced – 0.17%

Monzo: BlackRock MyMap 5 Select ESG – 0.14%

Nutmeg: Fixed Allocation Portfolio 3/5 – 0.21%

Vanguard: Vanguard LifeStrategy60 – 0.27%

Boring Money have assumed 1 trade per year for portfolios between £1k-£5k, 2 trades per year for portfolios between £10k - £20k, 4 trades per year for a £50k portfolio, 6 trades per year for a £100k portfolio, and 8 trades per year for a £300k portfolio. All trades are assumed to be into the funds referenced above

Individual provider assumptions and notes

For Fidelity, no regular savings plan have been assumed for portfolios under £25k, therefore customers are assumed to incur the full £90 annual charge on their portfolios

For interactive investor, the investor essentials plan has been assumed for portfolios under £50k, switching to the investor plan on amounts over £50k