Introducing Fund Investor Tracker

What is it? Boring Money’s bestselling service for Asset Managers.

Track sentiment and intention

Understand and measure Value

Evidence your customer demographics

Evidence customer objectives and understanding

Fund Investor Tracker explained

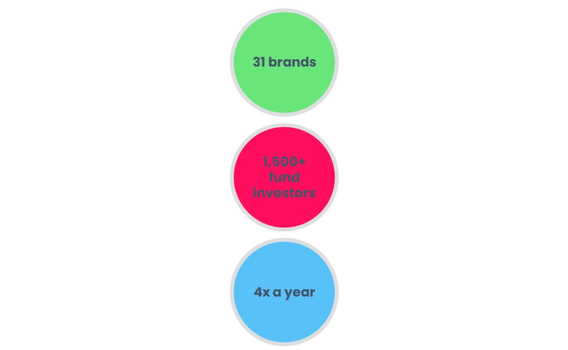

We track 31 of the leading fund management brands, building a comprehensive overview of retail investor sentiment towards your brand, whilst supporting benchmarking against peers

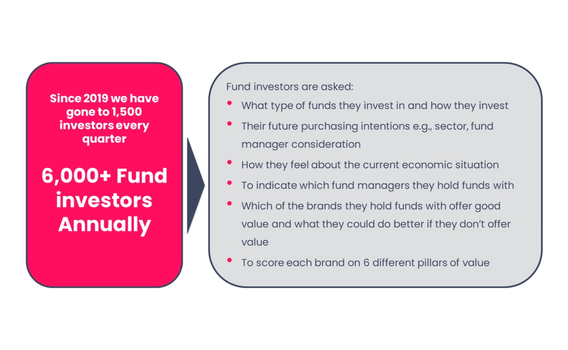

Our quarterly survey uses a sample of 1,500+ fund investors (advised and non-advised), giving you focused insights from the UK retail fund holder population

The depth of the sample size allows us to segment by customers of each asset manager, as well as the views of different demographic groups

Combining data from multiple quarters enables us to dive deeper into the demographics, behaviours and attitudes for holders of individual brands

We produce and share a quarterly deck and also support and take ad hoc questions relating to brand, sentiment, value and Consumer Duty

We can also supplement from our panel of consumers and add some deep-dive interviews for asset managers who want more detailed, qualitative insights

Our quarterly report on investors provides detailed insights on the ownership, views and intentions of fund investors. Based on a survey of end investors, it also provides teams and Boards with clear insights about what investors think, to support marketing, product, Assessment of Value and Consumer Duty project work.

*NEW-2022 upgrade – adding in Consumer Duty support

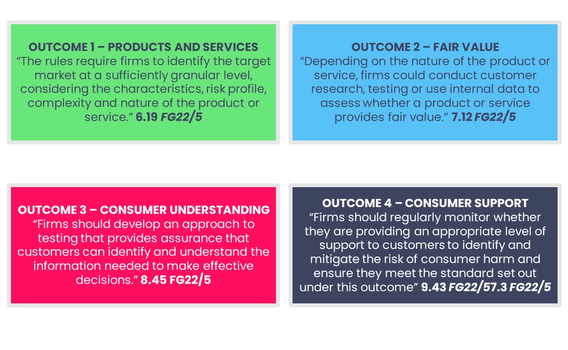

The Consumer Duty final guidance came out on the 27 July 2022. This new regulation comes of top of the existing requirements of the Assessment of Value process.

Asset Managers sales to end investors are typically intermediated though platforms and advisors. As a result, firms are cut off from knowing their customers. They don’t know who they are, what they think about their investments or what they need from investing.

Our audience insights will support Outcome 1 – understand your target market

Our Value insights will support Outcome 2 –understand what your customers think about value

We can also provide qualitative support for Outcomes 3 and 4.

What does the Fund Investor Tracker enable you to do?

1. Track sentiment and intentions

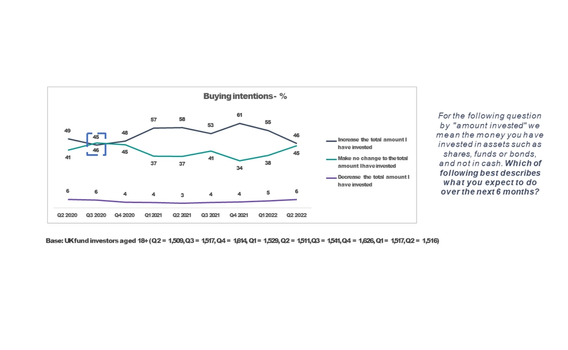

Sample insights from Q2 2022 - less than half of fund investors are planning to increase the amount the have invested in the next 6 months.

Buying intentions in next six months:

Fewer investors are planning to buy more over the upcoming 6 months.

Current buying intentions mirror pandemic times, with the proportion of investors planning to increase investment deposits in line with the proportion who are not planning to make any changes to their portfolio.

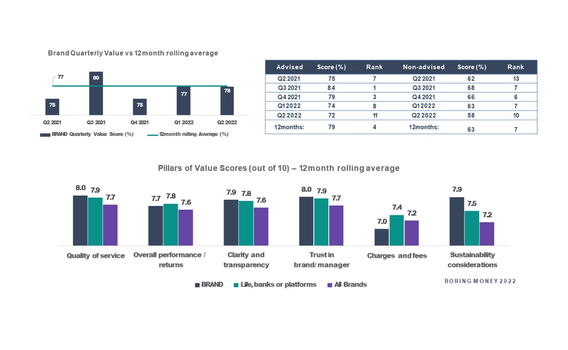

2. Track Value assessment from your customers

Sample Brand Scorecard – Value metrics as rated by investors

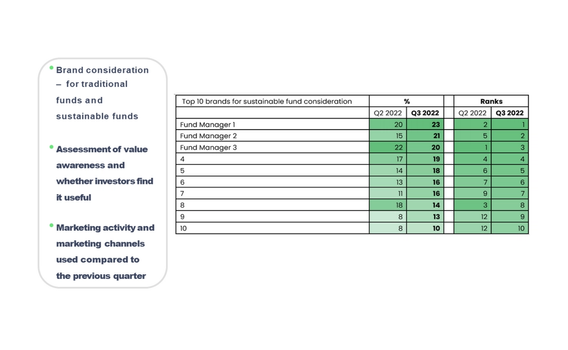

3. Track brand awareness and consideration

Track brand awareness – relative and compared to peers

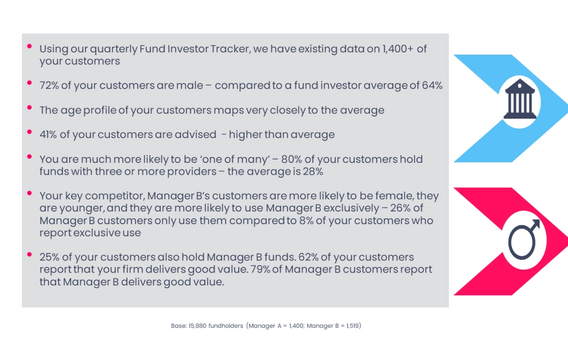

4. Support Consumer Duty Audience profiling

Support Outcome 1- Sample audience insights for Asset Managers

We can use our data to profile your customer base and compare to key competitors and peers – here is an example of insights provided to one manager against a named competitor.

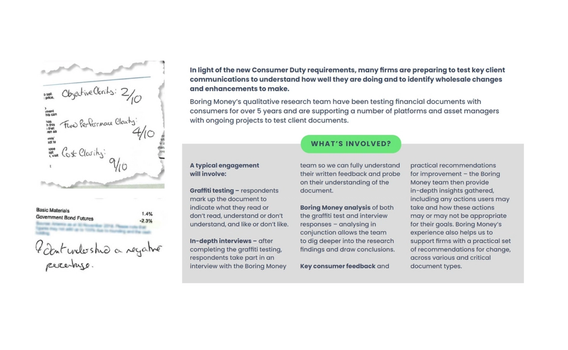

5. Document testing

This additional service has been created to support Consumer Duty

In light of the new Consumer Duty, many firms are preparing to test key client communications to understand how well they are doing and to identify wholesale changes and enhancements to make.

Report price

£5,500 + VAT per quarter

Minimum subscription of 1 year

Get the full Fund Investor Tracker report

Please contact rachel@boringmoney.co.uk for more information on how we support asset managers on AoV and Consumer Duty.

Our top picks

Explore more of our products to gain valuable insights and learn how we can help your strategy and propositions through our services.