Say goodbye to the cruise ship stock photos of retirement?

By Holly Mackay, Founder & CEO

5 Oct, 2023

Our new pension report provides a deep dive into the behaviours, trends and attitudes British adults have about pensions. One of the key takeouts is a generational – and actually quite moving - shift in how we visualise retirement.

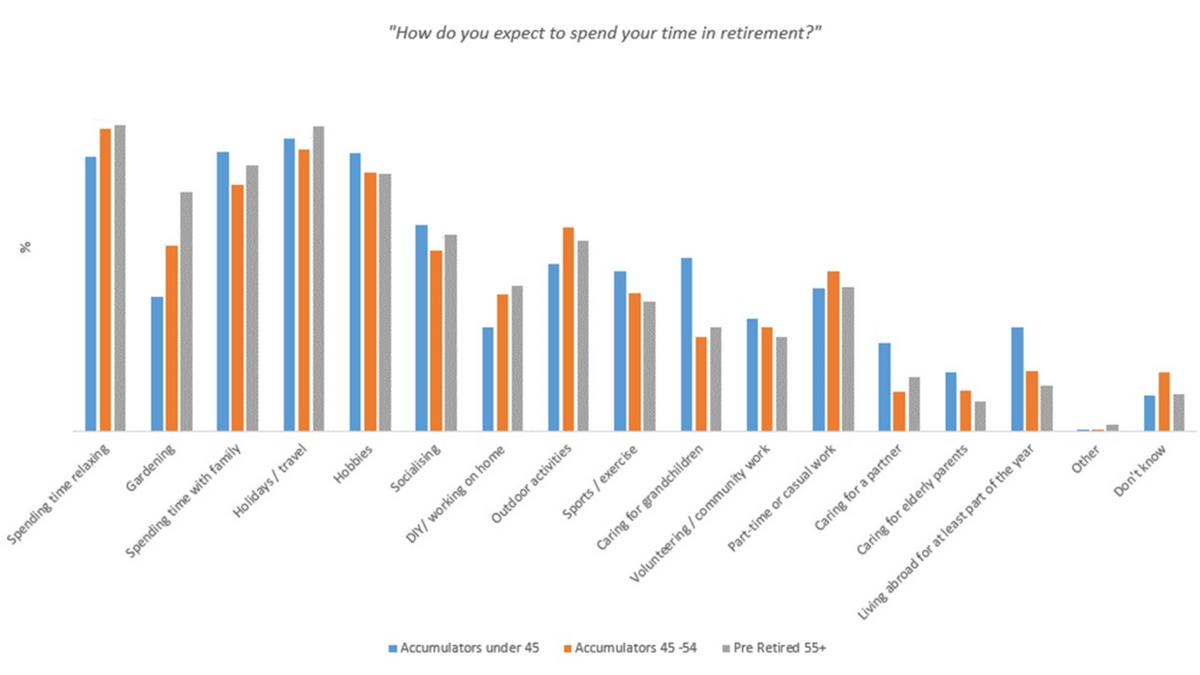

The under 45s have a very different picture of retirement, with caring responsibilities and work looming large. For this age group it is not a simple picture of leisure and holidays, but a more complex picture with less relaxation.

More under 45s are likely to say they'll use a private/work pension to fund their retirement than a State Pension. This lack of faith in the 'system' providing is stark - arguably realistic and smart, but also a little sad. It's part of a bigger picture about the image problem which the brand – “pension” - has. It’s not trusted.

This cohort is the most likely to visualise their retirement as involving work and care - with one-third of those under 45 expected to spend their retirement caring for grandchildren and 17% thought they would be caring for a partner.

By contrast the 45-54 age group have a more traditional view of retirement, planning time relaxing, gardening or spending time outdoors. Just 1 in 5 of this group thought they would spend retirement looking after grandchildren, reinforcing the serious tone of how younger people envisage later life, which reflects the broader societal problems around childcare costs, care costs and general affordability.

It’s evident that a more complex picture of retirement is emerging, so working out how to engage, attract and activate different segments needs some new thinking.

I recently spoke to someone who works at New College, Oxford. My old college. He was about my age. Very young :0) I asked about the most recent cohort of undergrads, what they were like? He said they didn't have the same 'lightness of being' that we did. This phrase has stuck with me. I find it descriptive and really sad - and it makes me want to try and help. There is a certain lack of 'lightness of being' reflected in our report findings.

This challenge highlights the responsibility the industry has for clear and meaningful articulation. We can’t provide a magic money tree. But we can remove the anxiety that comes from not being able to see something, or grasp it. By providing rules of thumb. Being clear on key bits of info that can be seen on a single mobile screen. And by talking about the WHAT and WHY of retirement for each cohort, rather than just the HOW.... and to do this well we really need to understand who precisely we are talking to. Bye bye blanket 20-page jargon-tastic comms for everyone.

The Pensions Report 2023 will highlight key changes amongst various demographics, with the aim to help you really understand the target market, opportunities and challenges for pension consolidation, pensions advice propositions, and SIPPs, supporting your growth, acquisition and engagement goals.

There’s also a feature chapter on consolidation, getting quite granular on sizing the opportunity by segment, as well as evidencing how to engage and activate. People are not awash with loose change at the moment – but more of them are considering consolidation.

Thank you,

Holly Mackay