Retail Distribution Report

The rise of the self-directed investor is changing the shape of distribution. For many asset managers with retail channels, more than half of all customers will be self-directed, even if today’s £ volumes still come largely from the advised channel. In the era of Consumer Duty, the need to understand these investors is significant. Direct books alone do not paint a representative picture of demographics, user journeys, costs paid, service or other factors.

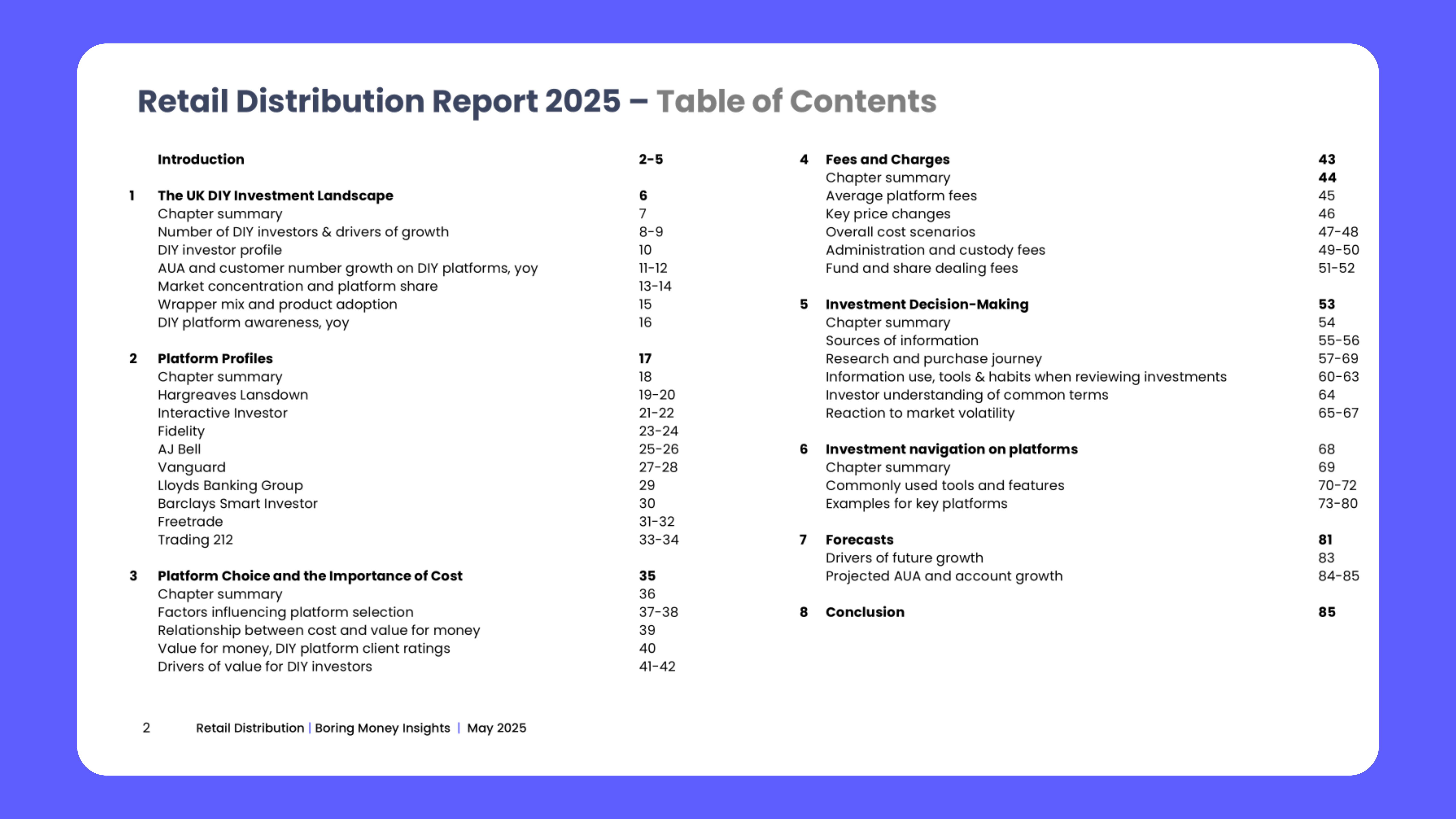

Download the Table of Contents

Get a free preview of the insights shaping distribution strategies in today’s self-directed landscape. Download the Table of Contents to see how asset managers can adapt to evolving investor behaviour, regulatory expectations, and digital transformation.

Who is it for?

This report is essential reading for asset managers, investment trusts, and wider market observers, including consultants and acquisitions, looking to navigate the shifting dynamics of retail distribution.

As self-directed investors play an increasingly dominant role in the market, understanding their behaviours, needs and impact is critical for those shaping and responding to modern distribution strategies.

This report will:

Key chapters

The UK self-directed landscape – data to support understanding of current self-directed landscape, and the scale of growth and change in recent years

Platform profiles – Profiles of 9 of the top self-directed platforms in the market, identifying commercial opportunities and understanding how platforms deliver value in unique ways

Fees and charges–Pricing tables for top platforms across a range of investor profiles and scenarios, helping asset managers understand both costs and value delivered to customers of key distributors, so considering value across the entire chain

Investor decision making –understanding what information is important to investors when purchasing and reviewing their investments, typical investment buying journeys and points of influence, and how this differs for Funds, Investment Trusts and ETFs

Forecast for £AUA and customer growth in the non-advised channel

What's in the report?

Sources and methods

Get in touch with us to buy the report

Please contact rachel@boringmoney.co.uk for more information or to request a call with the research team.

Our top picks

Explore more of our products to gain valuable insights and learn how we can help your strategy and propositions through our services.