Understanding Vulnerable Customers 2024

The Understanding Vulnerable Customers 2024 report aims to provide platforms, asset managers, and advice firms with critical insights into the characteristics and needs of vulnerable investors. This year, the report focuses on addressing the challenges posed by the Financial Conduct Authority's (FCA) Consumer Duty requirements, helping firms better understand and serve vulnerable customers.

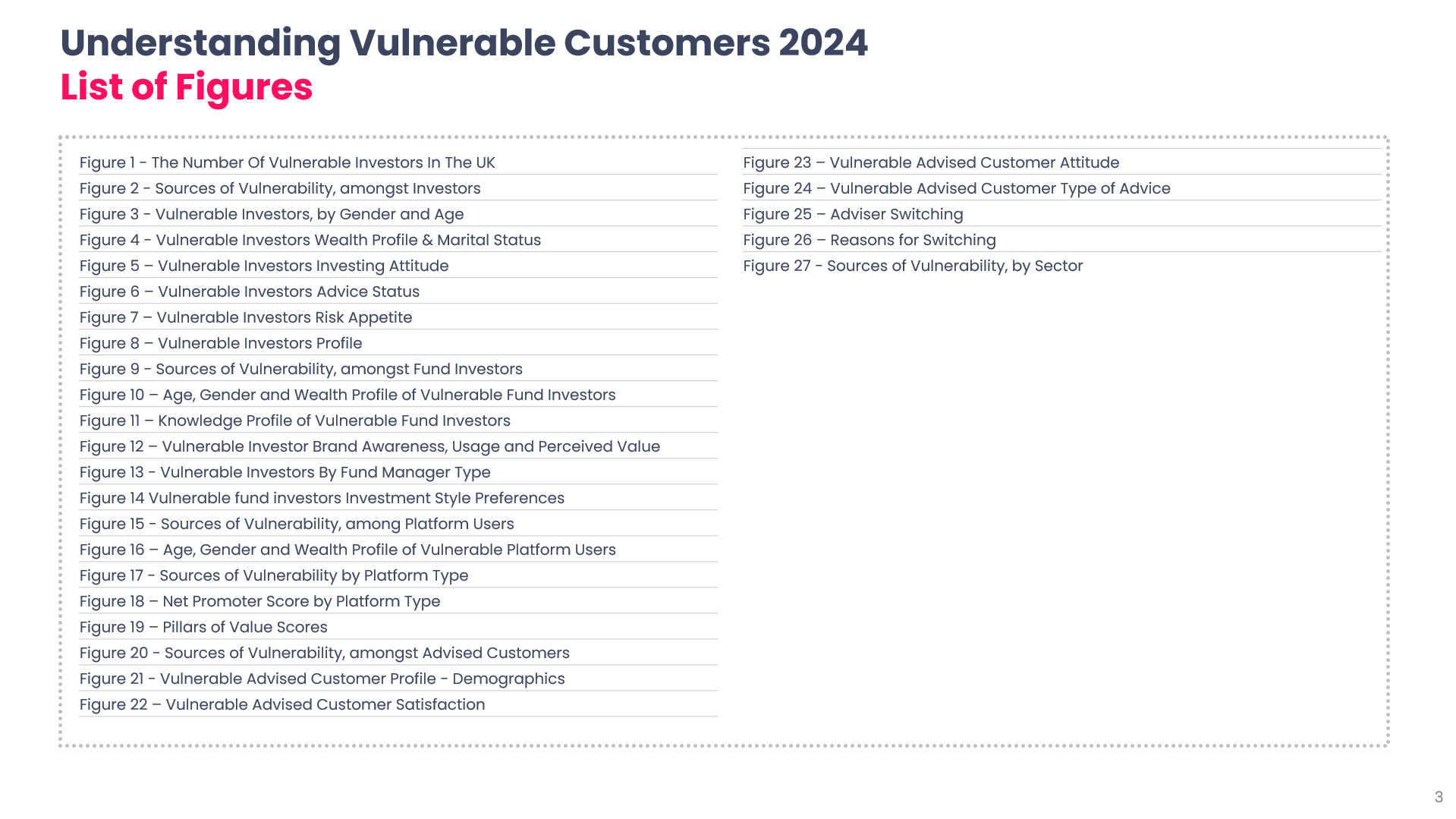

A Report Outline

Snippets of insights

What will the report support?

Prevalence of Vulnerability

Approximately 5.6 million UK investors exhibit at least one vulnerable characteristic, with low financial confidence being the most significant factor affecting 18% of all investors

Demographic Insights

Vulnerability is notably higher among women over 65 and individuals under 35, often with assets below £250,000

Sector-Specific Vulnerabilities

• Fund Investors: 27% are vulnerable, primarily due to mental health issues, leading to a preference for lower-risk investments and passive funds.

• Platform Users: 28% are vulnerable, with banks showing higher vulnerability rates.

• Advised Customers: 22% are vulnerable, with financial vulnerability being the most common issue.

Sources and Methods

The report is based on comprehensive surveys conducted among various investor groups, including:

• Survey of 6,486 nationally representative UK adults

• Survey of 6,058 UK fund investors

• Survey of 6,050 platform users

• Survey of 1,000 advised customers

• Survey of 523 Boring Money users

Get in touch with us to buy the report

Please contact rachel@boringmoney.co.uk for more information or to request a call with the research team.

Our top picks

Explore more of our products to gain valuable insights and learn how we can help your strategy and propositions through our services.