Archive

Boring Money has announced its 2026 Best Buys after an extensive review of over 40 leading DIY ISAs and pensions.

Discover Boring Money’s 2026 Best Buy ISAs and pensions, based on a detailed review of 40+ investment platforms and 27,000 customer ratings. See the top providers for beginners, ready‑made portfolios, and standout winners across ISA, pension, Lifetime ISA and Junior ISA categories.

January 1st, 2026

Hargreaves Lansdown cuts fees in dramatic move after holding out for over a decade

Hargreaves Lansdown cuts fees for 2m investors, dropping admin charges to 0.35% and slashing trading costs. Boring Money reveals who benefits most.

January 1st, 2026

Boring Money eyes Targeted Support opportunities as FCA publishes final rules

Holly Mackay discusses the FCA’s Targeted Support reforms, addressing the Advice Gap, key rule changes, charging clarity, and improved FCA-FOS coordination.

December 12th, 2025

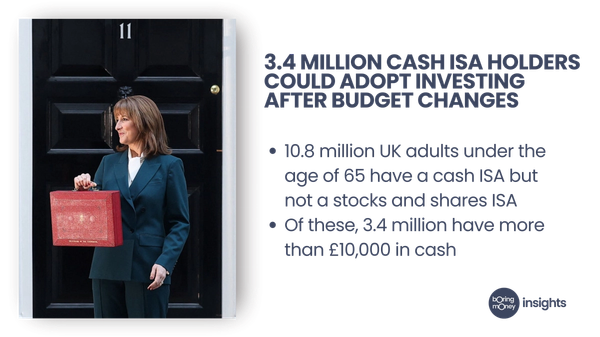

3.4 million cash ISA holders could adopt investing after Budget changes

Discover how Budget cuts to cash ISAs for under-65s could push 3.4 million UK savers toward investing. Boring Money reveals key data, expert insights from CEO Holly Mackay, and the latest platform interest rates and money market fund trends.

November 11th, 2025

Tony Stenning has joined Boring Money as Chief Commercial Officer

Boring Money appoints industry veteran Tony Stenning as Chief Commercial Officer. With over 30 years’ experience at firms including BlackRock, Downing and Atlantic House, Stenning joins to help drive consumer-focused innovation across investments, ahead of major industry reforms in 2026.

November 11th, 2025

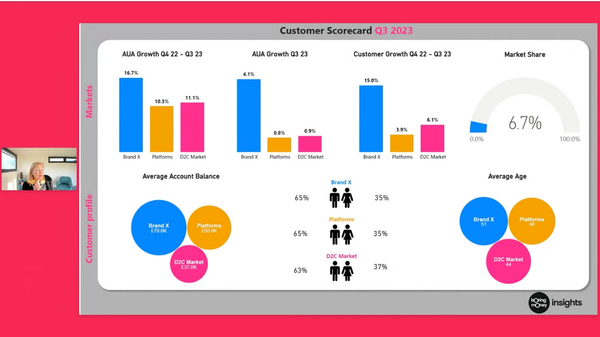

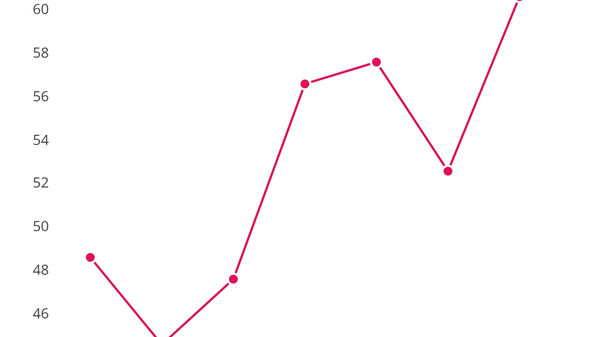

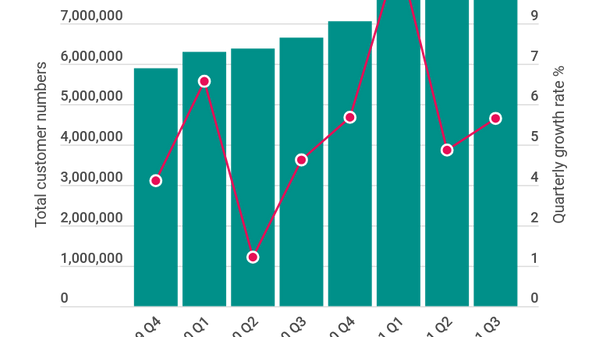

DIY investor market hits new high

Boring Money’s latest data reveals the DIY investor market has reached £547bn in Q3 2025, with 12.9 million accounts and strong organic growth from providers including Vanguard, AJ Bell, PensionBee, Aviva and interactive investor. Robo-advisers and challengers continue to outpace traditional platforms as customer numbers surge.

November 11th, 2025

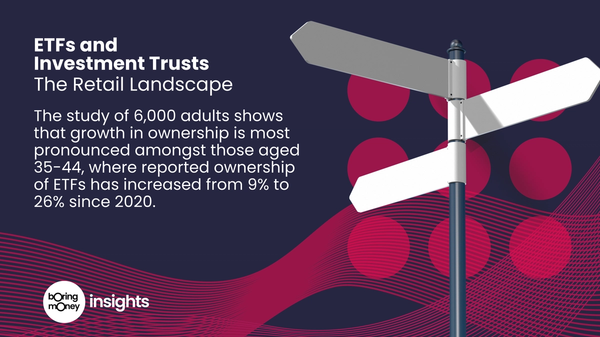

ETFs triple in popularity with self-directed investors

A new Boring Money report reveals ETF ownership among UK retail investors has tripled in five years, driven by 35–44-year-olds. ETFs are seen as cheap, easy, and diverse, with platforms like Trading212, eToro, and interactive investor leading the surge.

November 11th, 2025

Video Highlights: When Data Meets Design

A Targeted Support Prototype showing the impact of data and design to create engaging consumer journeys - a collaboration with Communify

October 10th, 2025

Battleground for pensions advice heats up as targeted support approaches

The pensions advice market is shifting as demand grows and DIY platforms face pressure from traditional advisers. Discover key insights from Boring Money’s 2025 Pensions Report..

October 10th, 2025

1.2 million older advised clients say their child will not stay with the current advice relationship when they inherit

New research reveals 1.2 million older advised clients doubt their children will stay with current financial advisers after inheritance, highlighting major retention challenges facing the UK advice industry.

September 9th, 2025

Here comes Targeted Support: The compliance view - where are the bear traps?

Explore the compliance risks, regulatory uncertainty, and operational challenges firms face as they prepare for FCA’s Targeted Support in 2026.

September 9th, 2025

Boring Money conference - my 6 key take-outs

Key takeaways from Boring Money 2025 - Change and Growth conference. Covering: Targeted Support, DIY boom, ETFs, FCA redress, risk warnings rethink & what it means for advisers.

September 9th, 2025

FCA “very confident” that the industry will get more comfort on the FOS as Targeted Support launch gathers pace

Regulator outlines AI use, annuities scope, data boundaries, and FOS alignment in shaping the future of advice and guidance

September 9th, 2025

FCA Outlines Next Steps on Targeted Support and Risk Disclosure at Boring Money's Conference

At Boring Money 2025, the FCA shares its vision for Targeted Support, closing the advice gap, and improving investor confidence through better disclosures.

September 9th, 2025

Willingness to pay for financial advice falls as other options open up

Boring Money’s Advice Report 2025 reveals falling willingness to pay for financial advice, with just 39% of non-advised investors prepared to pay, down from 54% in 2023, while interest in guidance, finfluencers, and alternative help sources grows.

June 6th, 2025

The Advice Report 2025 - Metamorphosis and Change

Discover Boring Money’s Advice Report 2025 – Metamorphosis and Change. Explore how Targeted Support, Consumer Duty, and evolving advice models create new opportunities for investments, pensions, and financial advice firms. Learn from our insights from real consumers to help bridge the advice gap and align strategy with demand.

June 6th, 2025

DIY Investment Market Hits New Peak, Surpassing £470bn in AUA across 12 million customer accounts

The UK D2C investment market reached £471.7bn in assets and 12M accounts in Q1 2025, with strong growth from digital platforms, according to Boring Money.

June 6th, 2025

Regulatory Communications Testing for Investment Firms

Ensure your customer communications meet Consumer Duty and SDR requirements. Independent, FCA-relevant testing with UK retail investors. Trusted by leading platforms and asset managers.

May 5th, 2025

Over Half of Retail Customers Are Now Self-Directed: What This Means for Asset Managers

May 5th, 2025

How we are supporting Asset Managers deliver higher standards for consumer protection?

Learn how Boring Money helps asset managers meet FCA guidelines and enhance consumer protection. With unique data-driven insights and tailored solutions, we support firms in understanding customer needs, improving products, and ensuring better outcomes for retail investors. Our Retail Investor Analytics service empowers firms to comply with Consumer Duty regulations and deliver higher standards of customer support.

March 3rd, 2025

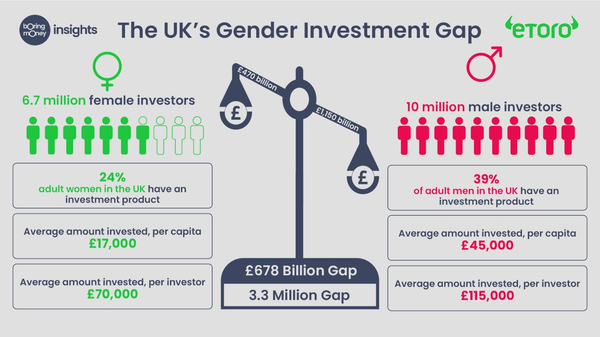

The Gender Investment Gap increases for second year in a row

The UK Gender Investment Gap has widened again, with men now owning 71% of all invested assets. eToro and Boring Money are partnering to drive change—discover how conversations can help close the gap.

March 3rd, 2025

The Winners of the Best Buy Awards 2025

Discover the winners of the Boring Money Best Buy Awards 2025, recognising top ISA and pension providers for outstanding investment services.

February 2nd, 2025

Fee-free ISAs change the cost landscape for DIY investors

New research from Boring Money reveals that stocks and shares ISA costs have continued to fall into 2025, driven by providers removing platform and custody fees. The cheapest ISAs now offer low costs across all portfolio sizes, while private pension fees have edged higher.

February 2nd, 2025

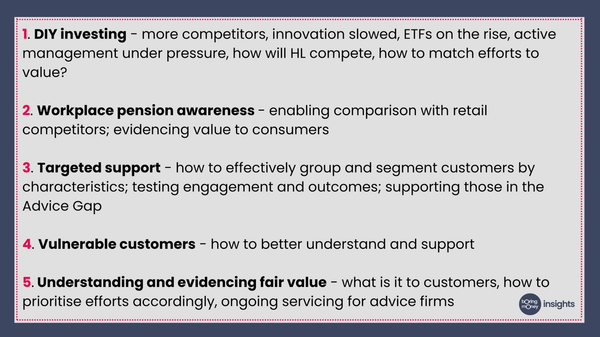

Holly's 5 things for 2025

Explore 5 strategic focus areas for 2025, including DIY investing, workplace pension awareness, targeted support, vulnerable customers, and understanding fair value. Get insights into the digital wealth landscape and upcoming trends that will shape the industry this year.

January 1st, 2025

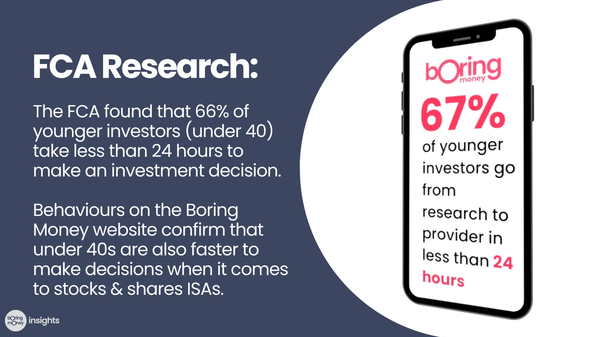

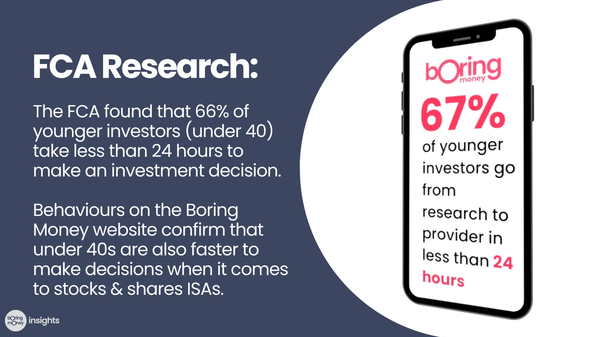

Responding to a report from the FCA which highlights the impulsivity of younger investors, data from the Boring Money website confirms that younger investors looking to open a stocks and shares ISA also move quicker than older investors.

Data from the Boring Money website supports the FCA report, showing that younger investors under 40 make quicker decisions when opening stocks and shares ISAs compared to older investors.

December 12th, 2024

News Response: Vanguard ends its reign as the lowest-cost option for smaller DIY investors but polishes its ready-made offer

Vanguard UK announces a new minimum annual charge for DIY investors, excluding managed ISA, pension products, and Junior ISA holders. This move shifts the focus toward their Managed ISA offering, with reduced fees making it more appealing.

December 12th, 2024

4 in 10 pension holders open to the idea of Targeted Support as FCA moves a step closer to implementation

The FCA has released a consultation paper proposing targeted support for pensions, a move welcomed by Boring Money CEO Holly Mackay. With 12.2 million people currently stuck in the Advice Gap, new research suggests that targeted support could help lift 5.3 million individuals out of this gap.

December 12th, 2024

Advisers underestimate the number of vulnerable clients

New research from Schroders and Boring Money highlights the prevalence of vulnerability among financial advisory clients. Financial, mental health, and emotional vulnerabilities are the primary concerns. Experts discuss the implications for client satisfaction, adviser retention, and industry challenges.

December 12th, 2024

The Boring Money Best Buy Awards 2025

We award Best Buy and Best For Awards based on a rigorous five-point methodology, assessing costs and charges, testing of customer service response times, reviews of the key features providers offer to customers, reviews from real customers, and our own analysis based on our test accounts.

November 11th, 2024

Consumer engagement with pensions rises despite only 13% receiving advice

The new Pensions Report 2024 from Boring Money shows that consumer engagement and activity is on the rise when it comes to pensions.

Consumer engagement with pensions rises despite only 13% receiving advice.

October 10th, 2024

Advice Gap to rise as a result of Consumer Duty as minimum asset levels increase

Speakers at Boring Money’s Consumer Duty III conference in London yesterday thought the Advice Gap would increase as a result of Consumer Duty.

Increased governance and costs of doing business are some of the factors putting firms under pressure to review their business models and who they are servicing.

September 9th, 2024

22% of advised customers are vulnerable as industry leaders challenge the label

Speakers at Boring Money’s Consumer Duty conference in London highlighted vulnerable customers as one of the main focus areas for firms in the coming months, as they rise to the ongoing challenges of Consumer Duty.

September 9th, 2024

New research published by Boring Money has confirmed growth in the Advice Gap in 2024 but confirms that some measures in the Advice Guidance Boundary Review could lift millions out of this Gap.

Research from Boring Money’s Advice Report 2024 shows the Gap has increased as there are more investors than before. Reported confidence amongst investors has fallen marginally, thus increasing the need for support and help.

June 6th, 2024

Could Sustainability labelling regime improve investor confidence and support better decisions?

In a broader regulatory shake-up of the sustainable investment sector, anti-greenwashing rules come into force on 31 May and are applicable to all FCA authorised firms. We have been tracking consumer sentiment in this space for over 4 years and can see that consumers’ scepticism about exaggerated claims remains an important deterrent to growth in the sector.

May 5th, 2024

Boring Money and Wealth Wizards announce strategic partnership to address Advice Gap

Consumer investment website Boring Money and financial guidance and advice technology provider Wealth Wizards have announced a strategic partnership to help millions of UK adults who fall into the Advice Gap.

May 5th, 2024

Sustainable investments 2024 - webinar and report

Boring Money is lined up to host its next online insight session. Join us at 9am on Wednesday May 15 for a dedicated webinar on the findings from our upcoming Sustainable Investing Report.

April 4th, 2024

Inflation eases to its lowest level in almost two and half years but investors remain negative about the UK economy

Inflation has eased to its lowest level in nearly two and a half years, but investors remain pessimistic. Boring Money insights have shown a stagnant sentiment about both UK and global economics from UK consumers. Holly Mackay comments below.

March 3rd, 2024

8 providers win Boring Money’s 2024 Best Buy ISA Award

Boring Money’s annual investment awards crown eight ISA providers and nine pension providers as winners of the coveted Boring Money Best Buy Awards 2024.

February 2nd, 2024

Broadridge and Boring Money Collaborate to Deliver Consumer Duty Solution for Asset Managers

Boring Money has collaborated with global Fintech leader Broadridge Financial Solutions, Inc. (NYSE: BR) to provide a single source of data and insights for asset managers that combines product analysis with consumer perspective to holistically address the requirements of the UK’s Consumer Duty regulation.

January 1st, 2024

Boring Money Best Buy Awards 2025

Is your brand in the running for one of our annual investment awards? Will you stand before the UK consumer as an exemplar of product, value, service and clear communications?

January 1st, 2024

Open position: Content Marketing Executive

The role will be split across our B2C and B2B arms, functioning as a cornerstone of core marketing activity. You will join a team that keenly balances strong visual design and skilled written comprehension.

December 12th, 2023

Boring Money's End of Year Insight Session 2023

We hosted our End of Year Insight Session - a consultative, data backed recap of the various developments and market dynamics that governed 2023. Watch the session here.

December 12th, 2023

Where did 2023 go??!! And what is in store in 2024?

On Wednesday 6th December 2023 at 9am we’ve hosted a round-up of 2023. What’s been going on in the world of wealth, investments and advice, then took a sneak peek at what’s coming up in 2024.

November 11th, 2023

Morrisons gin? Or Sipsmith?

It’s all “go” out there in Proposition Land with SJP’s pricing review providing the first major and very public demonstrable change which has Consumer Duty at its core.

October 10th, 2023

SJP’s announced changes to its charging structure

If you are covering retail finance and advice, consumer duty and assessment of value, please see comment below from Holly Mackay, CEO of Boring Money on SJP’s announcement to scrap exit fees.

October 10th, 2023

1.9 million UK adults consider consolidating their pensions over the next 12 months

As the cost of living crisis and ongoing lack of consumer confidence combine to hold back pension growth, consolidation remains a key opportunity for many firms. Learn more.

October 10th, 2023

Open positions: Senior Research Executive (Quantitative)

We're looking for a Senior Research Executive (Quantitative) to join our research team.

October 10th, 2023

Open positions: Research Manager

We are looking for a Research Manager with qualitative research experience, and experience in and/or a genuine interest in financial services research.

October 10th, 2023

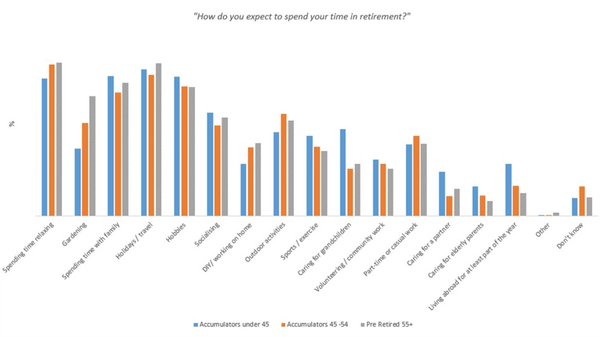

Say goodbye to the cruise ship stock photos of retirement?

More under 45s are likely to say they'll use a private/work pension to fund their retirement than a State Pension. This lack of faith in the 'system' providing is stark. Learn more.

October 10th, 2023

What do under 45s see themselves doing in retirement?

Our new report has been built with data from 4000 UK adults. It will help you to size the market, understand your audience, corroborate assumptions and plan your 2024 activity with confidence.

September 9th, 2023

Highlights from our Consumer Duty conference!

On September 12, Boring Money Insights hosted Consumer Duty- The Sequel, a half day event that gathered industry speakers from asset managers, platforms and advice firms for a dedicated Consumer Duty focused conference.

September 9th, 2023

Consumer Duty – The Sequel – What’s next for providers?

We look forward to welcoming you on Tuesday September 12th, where we are hosting leaders from across the industry at our half-day conference in London, to review how we did with the first Consumer Duty deadline, where to from here and how this will shape the landscape moving forward.

September 9th, 2023

What’s next for Consumer Duty? An Industry Leader Interview.

We asked one of our speakers – Chris Woolard CBE, Financial Services Regulation Leader, EY EMEIA – for his views on where firms have struggled, what change he thinks we’ll see and how tough a line the FCA will take in following up with providers. Read more here.

August 8th, 2023

Consumer Duty; the RFI tsunami and what investors are looking for

As the Consumer Duty deadline looms Boring Money Insights founder Holly Mackay recaps the insights, data points and document testing helping firms get everything over the line.

July 7th, 2023

Financial advisers less trusted than lawyers but more trusted than builders

New data from investment research and online publisher Boring Money shows that the average UK adult finds financial advisers less trustworthy than lawyers, police officers and priests. Read more here.

June 6th, 2023

The Future of Advice - Tipping the scales

Our annual report tracking the demand for, and the supply of, financial advice will be published on 14th June. We’ll be launching the report at a detailed briefing event for clients in the City on 14 June at 8:30am.

June 6th, 2023

Robo advisers hit 20% market share for the first time in the UK

Press release summary: New data from investment research and online publisher Boring Money shows that robo advisers now have a 20% share of all DIY customers in the UK, for the first time ever.

There are over 9.8 million DIY investor accounts in the UK as at Q1 2023.

Over 2 million of these accounts are held with a robo adviser – that’s a 21% market share by customer accounts.

These account for 4.2% of all DIY assets in £ terms.

May 5th, 2023

Webinar | Measuring the value of advice

Join us on 11th May at 9am as we share the findings of a recent research report by Boring Money. Our challenge was to help firms implement a framework to understand, and measure, the value of advice to support ongoing development and Consumer Duty requirements.

April 4th, 2023

New research reveals top value DIY platforms according to consumers

Press release summary: Latest research from Boring Money has revealed that PensionBee, Trading212, and Etoro rank highest in value for money scores by their customers. AJ Bell, Vanguard and Freetrade round out the top 5 respectively.

April 4th, 2023

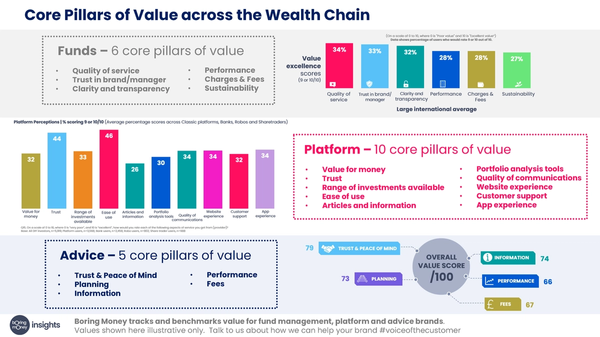

What is value - and who tops the value charts?

Consumer Duty is forcing platforms and advice firms to join the asset managers in the uncomfortably grey arena of value. But what is value?

We have been researching this with consumers for over 4 years now, helping asset managers to define and then assess value. We have recently started to capture this at scale for platforms, although with over 6,000 customer reviews of platforms on our site, we start with a pretty good view of what this looks like.

March 3rd, 2023

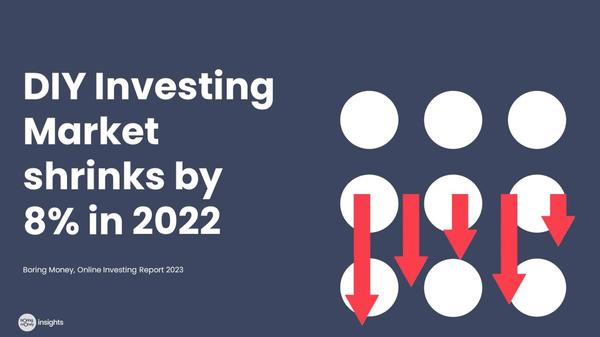

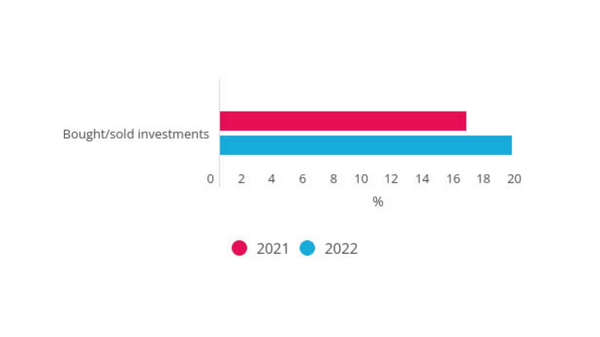

DIY investing market shrinks by 8% in 2022

Press release summary: The DIY investment market ended 2022 at £345billion, a small increase of 3.8% for the quarter but closing the year 8% lower, as markets struggle and consumer confidence falls.

February 2nd, 2023

Best Buy Awards 2023

Boring Money Insights awards its annual Best Buys, honouring the industry’s leading providers for DIY investors. Now in their fifth year, the Boring Money Best Buy Awards are increasingly used by our growing audience – and the media - who seek our impartial perspective, our deep dives into technical information, and the voice of consumers to inform their choices. This article will reveal the Best Buy winners 2023.

February 2nd, 2023

Open positions: Senior Research Executive (Qualitative)

We're looking for Senior Research Executive (Qualitative) to join our research team.

February 2nd, 2023

Open positions: Graduate Research Analyst

We're looking for a graduate research analyst to join our research team.

February 2nd, 2023

Vulnerable Customers... and a Christmas Competition

As we power into Christmas (and no we haven’t put on lights or started playing carols yet because it’s STILL ONLY NOVEMBER!! #grumpy) we have 3 baubles to put on your knowledge tree. One of which is an invite to our bumper Christmas quiz to anoint the DIY Investor Boffin of the Year.

December 12th, 2022

Best-selling funds, trusts, ETFs & shares of October 2022

With a slight nervousness about writing this the day before a Budget, which is not destined to be a Good News budget (#BritishUnderstatement), we’re pleased to share the bestseller lists across major platforms for October.

December 12th, 2022

5.6 million UK investors fall into the FCA’s definition of vulnerable

A new report published today by Boring Money finds that 34% of the UK’s 16.2 million investors are classified as vulnerable according to the FCA’s new Consumer Duty classification.

November 11th, 2022

Boring Money's Bumper 2022 Sector Review and DIY Investor Quiz

Join us on 8th December at 9am for the Boring Money's Bumper 2022 Sector Review and DIY Investor Quiz!

November 11th, 2022

Introducing Visible! – a new money service for women

Today, the Boring Money team proudly present Visible! – a new service to help the millions of women who say they feel invisible and ignored when it comes to advice, investments and pensions.

October 10th, 2022

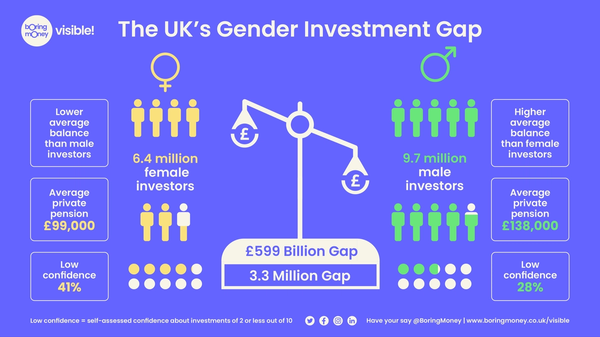

Women missing out on £599 billion in Gender Investment Gap

New research from independent consumer money site Boring Money has revealed that women are missing out on a potential £599 BILLION - which is greater than the GDP of Switzerland - in what has been dubbed the Gender Investment Gap. The survey of 6,000 UK adults found that there are an estimated 6.4 million female investors compared to 9.7 million male investors, meaning 3.3 million less women hold investments or private pensions in the UK - the equivalent to three times the population of Birmingham.

October 10th, 2022

Low-risk portfolios defy the description and post average losses of 12.7% this year

Boring Money has published the YTD (year to date) performance of 33 leading ‘ready-made’ investment portfolios, from 10 of the industry’s main providers of ‘ready-made’ portfolios or funds for consumers. These providers include popular options for DIY investors across a range of business models - platforms such as AJ Bell and Hargreaves Lansdown, robo advisers such as Moneybox, Nutmeg and Wealthify, and leading global multi-asset fund provider Vanguard.

October 10th, 2022

Why successful firms will embrace the 3 Cs

Finance has leapt off the personal finance pages and into the mainstream (again) in 2022. It’s harder than ever to make the right decisions and people are looking for help.

October 10th, 2022

Investor Insights - what people really want from sustainable funds

According to new research from Boring Money, renewable energy is the most selected impact theme for both investors and savers who would consider ESG-focussed investments. With an eye to the future, big oil companies have tried to pitch themselves as those who will invest in renewable, but this message hasn’t been well received by the majority of investors. Simultaneously fund managers have to focus on persuading the average investor that engagement, not exclusion, is a sensible strategy.

August 8th, 2022

Our Sustainable Disclosure Prototype

August 8th, 2022

Savers and investors cite greenwashing as a barrier to investing, as data reveals misalignment in sustainable classifications

One of the focusses of the recently released Consumer Duty Policy Statement is how investment firms look after and manage vulnerable customers. In further guidance, vulnerability is classified as those customers who need special consideration because of 1) health, 2) life events, 3) financial resilience and/or 4) capability (knowledge and confidence).

August 8th, 2022

One in three of all investors fall into regulator’s definition of vulnerable

One of the focusses of the recently released Consumer Duty Policy Statement is how investment firms look after and manage vulnerable customers. In further guidance, vulnerability is classified as those customers who need special consideration because of 1) health, 2) life events, 3) financial resilience and/or 4) capability (knowledge and confidence).

August 8th, 2022

Boring Money respond to Hargreaves Lansdown’s comment on FCA Consumer Duty

Boring Money CEO Holly Mackay comments, “The 3rd Consumer Duty Outcome is Consumer Understanding. We know that the use of ‘simple English’ and no jargon is a key consideration for investors when choosing an investment product (51%), second only to a low annual cost (58%). The FCA say “we want consumers to be given the information they need, at the right time, and presented in a way they can understand.”

July 7th, 2022

Financial sentiment has hit new lows not seen even during the pandemic

Net financial sentiment has fallen to -40, down from -17 in January 2022. 50% of people believe their personal financial situation is going to get worse, compared to just 10% who think it is going to improve.

July 7th, 2022

Appetite for sustainable funds remains high despite lower investor confidence and understanding

New research from Boring Money’s Sustainable Investor Tracker shows which asset management firms are winning the battle for consumer brand buying intentions when it comes to sustainable funds.

June 6th, 2022

28% of advised customers today would prefer a fixed-cost one-off advice model

New research from Boring Money shows clear customer preference for more flexible advice models to suit a broad range of needs and preferences.

May 5th, 2022

Advice Gap reaches new high of 13.2 million as interest in digital solutions rises

There are 9 million adults with investments today who express low confidence in managing said investments, and 4 million adults with more than £10,000 or three months’ worth of salary exclusively in cash savings who are willing to invest.

May 5th, 2022

Open positions: Strategic Relationships Manager

The Strategic Relationships Manager will sit in our newly formed Commercial Team and is a B2B inside sales position with new business acquisition and account management responsibilities.

April 4th, 2022

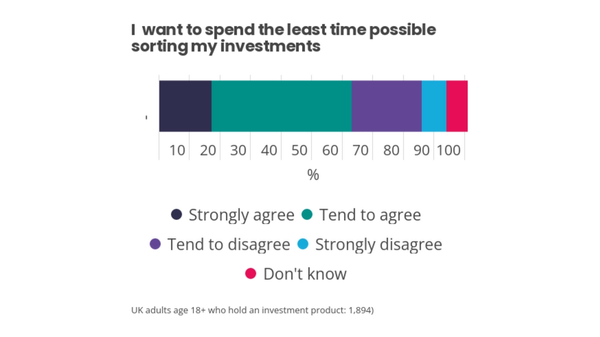

How much time are people willing to spend on investing?

How much time are customers willing to spend on investing?

March 3rd, 2022

Our Sustainable Disclosure Prototype - join the live webinar

Join our ESG disclosures webinar to learn what investors want

March 3rd, 2022

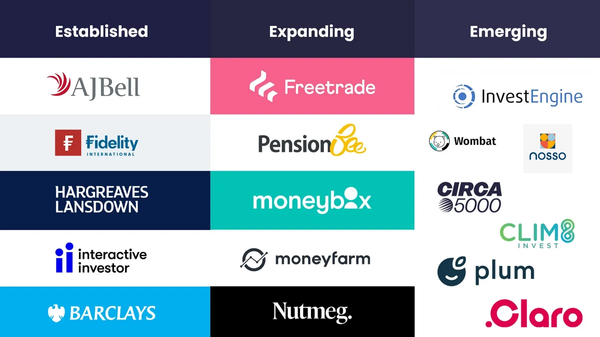

Established, Expanding, Emerging: The 3 tiers of DIY investing

Boring Money Analysis of the DIY investing market. Where will it go next?

February 2nd, 2022

How mobile became critical for winning new customers

Online Investing Report Boring Money. Mobile investing critical for DIY investing providers.

February 2nd, 2022Press release: Online Investing Report

Press release: Boring Money Online Investing Report

February 2nd, 2022

Disruptor brands post strong customer review scores

Disruptors in the DIY investing market register strong customer review scores

February 2nd, 2022

Are your customers old & grumpy?

Are you investors Old and Grumpy?

February 2nd, 2022

Investing intentions on the rise

Retail fund Investors are planning to increase the amount they are investing

February 2nd, 2022

The top rated fund managers for Value

Read about the Boring Money Best Buys 2022

February 2nd, 2022

Boring Money 2022 Best Buys

Our Best Buys Awards are based on reviews from real customers, as well as our analysis of costs and charges, testing of customer service response times, and review of the key features providers offer to customers.

February 2nd, 2022

Pot Consolidation set to grow

January 1st, 2022

How are mobile investing apps changing customer behaviours and expectations?

January 1st, 2022

How is the investor population changing?

January 1st, 2022

Advice and the growing acceptance of remote contact

January 1st, 2022

Pensions: Consumers and Consolidation

January 1st, 2022

Fears of Greenwashing are a threat to the growth of Sustainable Investment

January 1st, 2022

Q3 '21: DIY investor market exceeds £360bn but pace of growth slows

January 1st, 2022

Investor Tracker: Fund buyer sentiment declines in Q3

January 1st, 2022

test sub group: Responding to a report from the FCA which highlights the impulsivity of younger investors, data from the Boring Money website confirms that younger investors looking to open a stocks and shares ISA also move quicker than older investors.

Data from the Boring Money website supports the FCA report, showing that younger investors under 40 make quicker decisions when opening stocks and shares ISAs compared to older investors.

December 12th, 2010